BITCOIN! BITCOIN and other CRYTPO Currencies. A long awaited commentary. December 25, 2017

Wishing all of you the merriest of holidays and a prosperous New Year. (not a proposterous one like 2017)

Hi all you fans of Money Matters and monetary truths everywhere. I get so, so, so many questions on Bitcoin and crypto currencies, I finally started commentary on them here today. Keep in mind, much like "pot" investments, the regulators as super careful about what is said by registered financial professionals. Hence the time it took for me to comment. But here is the start of many. Read below and feel free to send me an email with your questions. And it Bitcoin a part of your strategy? What IS your strategy for 2018, your retirement and beyond? Do you even have one? Why not sit down with me and lets talk over lunch? The cornerstone of progress is education. Let's you and I start yours on your money. Call me (530) 559-1214. It costs nothing to sit with me and chat. (Minimums apply as to your portfolio) Call for those numbers. Look forward to hearing from all of you.

Before we begin, take notes of some things taking place as to Money Matters.

1- Seminar coming! Stay tuned for date and time, location and topics.

2-Next show is January 4th, 12:00 pm PST at noon. Look forward to a special surprise if I can swing it!

3-"Investing in Community" video series is growing by leaps and bounds. Check out my Facebook page to see all of them. Our last video recieved over 8000 views! We can profile your business, event or non-profit. Contact me for details!

Now keep reading and stay frosty!

marc

--------------------------------------------------------------------------------

Hello Money Matters fans,

I am asked my opinion about Bitcoin A LOT!

I saw this article and thought it was spot on as to my opinion. Keep in mind this is a third party article. I have an original article forthcoming after I get it approved by the regulators. For now read this and take a long hard look at this chart below. I have furnished a real estate chart at the end of this article for your comparison. See what you think!

Good reading...

marc

-----------------------------------------------------------

Bitcoin representative Price Chart

(An article by Matthew Carr of Energy Resources and Digest: Matthew Carr, Emerging Trends Strategist, The Oxford Club)

Bitcoin's Ambitions Are Unattainable... but That's OK

Let's get real... Bitcoin isn't a currency.

Not a real one. Not even a fake one.

I gave a vocal diatribe in the office the other morning, exclaiming that if you're using bitcoin as a currency - to buy things or services - you're an idiot.

You are dumb.

And you should hang your head in shame.

Why would you ever willingly spend something that was $600 in July 2016 that then shot to more than $15,000 by December 2017?

That's madness.

Bitcoin's price move over the past year must convince you that it has no value as a currency...

It has gained 1,825.5% in the past year.

As of this writing, bitcoin has shot up 152% since November 12.

That's the reality.

And no merchant or business can accept a form of payment that volatile. It makes no sense.

That's why we're starting to see companies dump bitcoin as a payment option.

Recently, the video game streaming service Steam announced it would no longer accept bitcoin. In April 2016, when the company announced it would begin using the cryptocurrency, bitcoin was trading around $450.

More importantly, transaction fees for bitcoin were a mere $0.20.

But as bitcoin's value increased - and volatility picked up - the transaction fees increased 9,900%! That far outpaces the uptick in bitcoin's price.

Let's remember, bitcoin's rise this year hasn't been smooth. Just in the last couple of months, bitcoin has cratered quickly (and I've pointed out that you need to buy at the dips).

From June 10 to July 16, bitcoin slid 34.1%...

From September 1 to 14, its price fell 34.9%...

From November 8 to 12, the cryptocurrency tumbled 21.5%...

That's unsustainable for a business - let alone a consumer - to accept as a form of payment. With all that volatility, there's increased risk. And those increased fees are controlled by the merchants.

On top of this, we've all heard of the $21 million pizza debacle (though it's exceptionally more than that now).

"Bitcoin Pizza Day" is celebrated in the cryptocurrency world. It's a folklore tale that proves why bitcoin can't succeed as a currency.

On May 22, 2010, Laszlo Hanyecz agreed to pay 10,000 bitcoins to have two large Papa John's pizzas delivered to his house. It was a bad deal to begin with because the bitcoins were worth $41 at the time and the pizzas cost just $25.

A little more than seven years later, those 10,000 bitcoins are worth $147,635,200.

Hanyecz is the Ronald Wayne of the cryptocurrency world. For those not familiar, Wayne sold his 10% stake in Apple (Nasdaq: AAPL) for $800 in 1976. He'd be worth more than $75 billion today if he'd kept it.

Bitcoin is a fine investment - if you understand and fully appreciate the risks. But people that believe this is the future of commerce are misguided.

None of this is viable with the current volatility. A useful currency can't gain 100% in a month or a week... and then lose 34% over the course of a couple of days. That goes for all cryptocurrencies.

If you've ever used bitcoin or another cryptocurrency to purchase anything, you are a fool. You've made a grievous error and have given up way more than you received.

If you've ever sold stuff in exchange for bitcoin, you are a genius.

That in and of itself isn't a successful model for commerce. And that's why to me, bitcoin will always be "digital gold."

It's a commodity - not a currency.

Good investing,

Matthew Carr

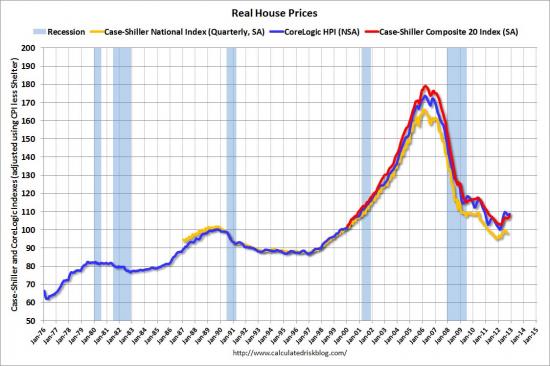

Now compare the price action in real estate- you can draw your own conclusions

(Chart submitted by Marc Cuniberti and not a part of the original article)

Article credit and information:

The Oxford Club: Oxford Club.com

This is a third party article penned by Matthew Carr. It is the opinion of Matthew Carr.

This article expresses the opinions of the author and are opinions only and should not be construed or acted upon as individual investment advice. Mr. Cuniberti is an Investment Advisor Representative through Cambridge Investment Research Advisors, Inc., a Registered Investment Advisor. Marc can be contacted at MKB Financial Services 164 Maple St #1, Auburn, CA 95603 (530) 823-2792. MKB Financial Services and Cambridge are not affiliated.