Update on the markets, fire insurance and more December 21, 2019

Fire Insurance

Update:

276108

In my continuing coverage of the Cal Fair Insurance Plan, much like the assigned risk program for problem drivers, the Cal Fair Plan takes on the high risk homeowner’s insurance policies individual insurance companies will not. The problem obviously is wild fires given the complete obliteration of whole neighborhoods in recent years. Wildfire being the high risk peril they fear (a peril is a cause of loss) insurance companies have not completely pulled back from issuing policies for homeowners in high risk fire areas, they have just removed coverage for fire from their policies. They still cover all the other perils they have always covered except specifically removed fire. These policies less the fire coverage are commonly called “wrap” or “difference in conditions” (DIC) policies.

Issuing these DIC policies is not a problem for insurance companies. They more than happy to do it. It’s the fire coverage they are now avoiding in many cases.

Enter Cal Fair. Established in 1968 in response to 1960’s brush fires, one could safely say its never been tested to the degree it is now. Cal Fair covers single family homes, rentals, vacation homes, condominiums and a host of other dwellings which include commercial businesses, office buildings and more. They also cover earthquake through the California Earthquake Authority (CEA).

The Cal Fair policies are commonly referred to as bare bones policies, encompassing fire and earthquake coverages only with coverages extending to personal property, other structures, loss of use, ancillary property of certain types and other optional endorsements which all basically centers around fire. Recently the Department of Insurance has ordered Cal Fair to add coverages to resemble a combination of a DIC and fire policy which would make the Cal Fair policies more like the Homeowners policy of old, which covered everything common to a homeowner policy and covered it all in one policy. As of now however, before those changes take place, you will need two policies if routed to Cal Fair.

Cal Fair is actually rather simplistic for both homeowners and agents. For homeowners, Cal Fair being the bare bones policy it is, understanding Cal Fair is a lot easier than the old policies, at least in this analyst’s opinion. You’re basically covered for fire and fire related perils with a just handful of options. For agents, the application is fairly easy to complete and the quoting process is straight forward. Where previously applications from individual companies may have involved estimating programs drawing on public records and owner history for valuations, Cal Fair makes it clear it does not estimate nor warranty its coverage is adequate. You pick the valuations and that’s it. If it costs more than the amounts selected, you’re out of luck. Although replacement cost endorsements are available (versus what they call “actual cash value” where depreciation of your property may come into play), once you reach the limit that’s it. No more will be paid no matter what it costs. Certain coverages can bleed over to another, such as allowing a certain percentage of the dwelling coverage to help with another coverage if needed, but that bleed over amount reduces the coverage of the coverage that was drawn from. For instance, if you need more money to cover your loss to your stuff inside the house (known as personal property) you can use some of the dwelling coverage amount to supplement costs that have exceeded the stated limit. What you use however will lower the limits of the dwelling coverage available. Sort of like robbing Peter to pay Paul, but Peter won’t have as much to cover whatever he was covering.

There are a few hooks in these policies as well. If the house is older than 25 years old and the roof hasn’t been replaced, Cal Fair removes the replacement cost guarantee for the dwelling. That means in a total loss they will replace the dwelling to the market value (the amount you could have sold it for less the the land) at the time of loss, which is not really that terrible.

However in a partial loss, they will pay only the depreciated cost with the following explanation: “A deduction for physical Depreciation shall apply only to components of a structure that are normally subject to Repair and Replacement during the useful life of that structure”.

Reading what that means is a bit subjective and open to interpretation and I have received two different explanations of what this actually means from Cal Fair. You might interpret this as the roof, decks and carpets will be settled at a depreciated cost as those items do wear out whereas the walls and basic structure does not.

I have also been told this only applies to the roof itself. All I know for sure is if the roof is over 25 years old I cannot plug in the replacement cost endorsement on the Dwelling portion of the policy (known as coverage A) and the result is the policy premium is cheaper.

In my opinion and in the opinion of many agents I have spoken to, this is all one big grand experiment as to what is happening and what will happen given another firestorm wipes clean another town or city. For now however, we can all hope we throw our money down an insurance rat hole and we never have to find out by actually using the coverage. Kind of strange way of thinking about it I suppose but it’s the reality of the situation. No one wants a fire to rage through their home but most of us want to be covered if it does. How we do that, if it will be sufficient or not and how much it will cost is constantly changing along with the firestorms that threaten our homes and neighborhoods.

You can see a sample of a Cal Fair policy here: https://www.cfpnet.com/wp-content/uploads/2017/04/ImportantNoticeDwellingContract04252017.pdf

It doesn’t make for the most entertaining reading but it could be the most important thing you read all year.

Money News....

Black Friday stores are not so well lit lately. Thank cyber Monday for that. Another American tradition may be fading into history as online shopping in slippers lures shoppers away from strip malls and to stay home and eat turkey. Consumers spent 11.3 billion Thanksgiving and Black Friday online however so the tradition may be still there but instead of venturing out, shoppers are just staying home munching on turkey getting their keyboards greasy. In a new twist about 2.9 billion of the online shopping came from the trusty mobile platforms, in other words phones.

A few diehards did hit the malls driving up mall sales 4% but much of that I suspect is just higher prices and not necessarily an increase in actual units sold. Adobe Systems meanwhile projects Cyber Monday sales north of nine billion. Lots of greasy keyboards on Monday as well.

Is the mall rat dead with four feet up, caught once and for all in the online shopping roach motel?

We will see in years henceforth but my guess is eventually yes.

Meanwhile likely not much shopping done by a group of New York City construction workers in the solar industry who happened to follow Representative upstart Alexandria Ocasio-Cortez (AOC) down another one of her rat holes. They likely couldn’t afford to shop anywhere. The workers, after being convinced to unionize by AOC, witnessed something unexpected happen. The company Bright Power fired them all, saying among other enlightenments: “it makes business sense to return to a fully subcontracted solar installations market”.

Welcome to free markets boys and girls. This is still America and private companies still have the right to turn a profit and do what is necessary to accomplish that task. Nice going AOC and welcome to the real world X-Bright Power employees now joining the lines at the unemployment office. That union idea sounded good at the time. Now its coal for Christmas. No harm no foul for AOC. She tweeted a nasty response then retreated to her swank condominium to shop online. So goes the rumor anyhow.

The Federal Reserve also wants to get into the game of lengthening unemployment lines. They are looking for a new inflation target for the U.S. economy. Already setting the inflation rate at 2%, where it’s been since 2012, this rate will erode your paychecks purchasing power 18% every ten years. Yikes.

And they want to make it worse?

Yes they do. Failing to hit the 2% target in recent years consistently, they are debating jacking the target higher to make up for lost ground. How would they go about raising inflation? Do what they always do: print more money and firehose it into the system. Unfortunately the hose points mostly into the banking lobby doorways. Oh, and Wall Street gets drenched as well. After all, the Feds aint so good at hitting targets now are they?

Great stuff, a great financial commentary newsletter, made a hilarious observation about the exercise bike company Peloton. You know the one. The have the most prominent exercise bike ad on the television today. Picture a healthy young stud or muffin riding to a TV screen with an interactive coach via the internet egging them on. You’ve seen the ads. The bike is not cheap compared to what I paid for my Schwinn sting ray in the 60’s. Try 800% higher. Somewhere in there. You do the math. Anyway Great Stuff notes that to buy a Peloton, seeing the ad you apparently also have to have a big room with a large picture window. Like I said, you’ve seen the ad right?

The Democrats are up to their usual shenanigans in response to the GOP’s usual shenanigans. Plowing forward with impeachment hearings, it’s no wonder the U.S. government is about to hit the debt ceiling again. What’s the debt ceiling? Apparently it doesn’t matter anyway so were told so never mind.

Now for something new and entirely different. The Dems are also trying to raise taxes again. This time they’ve targeted social security. No, not the fund itself but the people that pay into it. They are proposing to raise the cap on the income exclusion. Basically once you make so much in income, the amount over a certain number is no longer subject to social security taxes. Can’t have that can we?

Actually since the trust fund called Social Security had little trust in its management over the years (they spent it all and some), you have to get more money somewhere. So let’s tax the rich. Like I said, time for something new and entirely different.

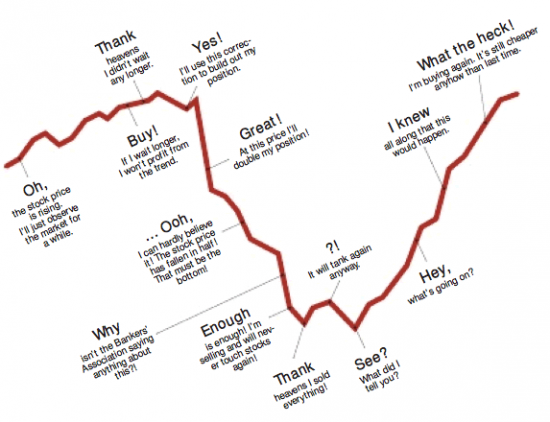

Did you bargain for this ride?

276481

How is your advisor doing and how are they doing it?

Take the case of two advisors, A and B. Both advisors start out with a 100K portfolio. At the end of 12 months, advisor A has grown the portfolio to 106K while advisor B ends with a 103K balance.

Which is the better advisor?

Asked at multiple seminars I have given, the answer is usually the same. Advisor A is superior.

But much like a young man taking your daughter out to the prom who arrives at the dance safely and on time while another teen suitor arrives late, the end result does not necessarily mean the correct answer was the obvious one. In fact, it could be just the opposite.

In the case of the first young suitor who arrived on time, perhaps he drove a little too fast, ran some red lights and failed to come to a complete stop while transporting your precious little jewel while suitor 2 took his time driving more carefully.

The same could be said of the two advisors.

Much like the teen driver, in the two advisor comparison and how they managed the portfolios and their ending balances, the better answer is just how did they get there?

It’s true the end result from advisor A bested advisor B by a 100% margin (3k return versus 6K), but just how he did it is the real concern.

The word “risk” would be a key factor in this equation as well as the symptom of that risk which I call drawdown and take up.

I’ve talked to many investors and money professionals alike, and more often than not, the end result is the main consideration surrounding how one advisor did compared to another.

A serious flaw in my opinion, yet the underlying problem in this thinking will only be known when it’s usually too late.

The level of risk each advisor subjects his client to should be one of the main considerations when evaluating performance. In investing circles it is sometimes referred to using a technical term called “beta’. Beta is the degree of comparative movement a security historically exhibits when the overall market moves up or down.

A beta of 1.0 means the security has an historical tendency (but not a guaranteed predictor of) to move in lockstep with the overall market.

For instance, if stock A has a beta of 1.0, if the market drops by a certain percentage, stock A will be forecasted to drop a similar amount. Note I said “forecasted” and “similar”. Beta is a historical value, based on the past, and therefore is no guarantee of anything. It’s just represents what it has done.

If stock B on the other hand has a beta of 2.0, it has moved twice the degree of the overall market in the past. Conversely a number below 1.0 (such as .5) means the security may move half the amount of the overall market. A lower beta is assumed to less volatile and therefore more “conservative”.

One can surmise the beta of a portfolio overall by adding the beta values of each security and its percentage of the portfolio make-up then divide by the number of securities in total. This would give you the beta of the portfolio.

Continuing on, in our example of advisor A and B, “drawdown” means how much under 100K did the portfolio move at its lowest level, and “take-up” (my term) means what is the highest level it reached. The ending value (103K and 106K) in our example is the “end result” that is being evaluated.

If advisor A had a higher beta in the portfolio than advisor B, one would expect the drawdown of advisor A portfolio would be a greater number. An example might be the advisor A portfolio may have seen the 100K drop to 93k sometimes during the course of the investment time period while the advisor B portfolio may have only dropped to 97K. Fictional values here of course but it illustrates the point: the end result means little if you don’t know how it got there. In simple terms, what risk was the client exposed to using either advisor A and B, was it what the client expected and was it the appropriate level of risk the client should be exposed to given his particular situation.

In an up market, advisor A would likely yield better results, but much like our teen driver rushing to the prom, all is well until it isn’t. In a down market, the advisor A portfolio would probably mean bigger losses.

If a crash in the market was to occur, advisor B would likely be the driver of choice.

And much like a vehicle crash, you wouldn’t know just how bad the outcome might be until after the fact. And at that point you may wish you had picked the slower driver.

These articles expresses the opinions of Marc Cuniberti and should not be construed or acted upon as individual investment advice. No one can predict market movements. Investing involves risk. You can lose money. The example is a fictional illustration only. Mr. Cuniberti is an Investment Advisor Representative through Cambridge Investment Research Advisors, Inc., a Registered Investment Advisor. Marc can be contacted at SMC Wealth Management, 164 Maple St #1, Auburn, CA 95603 (530) 559-1214. SMC and Cambridge are not affiliated. His website is www.moneymanagementradio.com. California Insurance License # OL34249