Money Matters update November 17, 2014 PLEASE READ.

Marc’s Notes:

Turkey Matters is coming to a close. Thanks to all who supported this matching program for Turkeys. It looks like about $2,000.00 or so will go to our local food banks. We can eat our dinners knowing we helped feed literally over a thousand people with all the turkeys we bought!

-------------------------------------------------------------------------------------------------------

As to the market, the rout from last month is definitely concluded. Now the green light is on at least for now to buy stocks. I have included the blurp on the SUPER DIVIDEND PAYERS LIST I updated for you to read. Many great stocks are on sale due to the pullback and this list is a great way to peruse my selections. Read below at bottom of this newsletter.

With oil still down, the economy looks to have more disposal income from consumers.

Now all eyes turn to the holiday shopping season. How will retailers do? How much will consumers spend?

As is every year, the shopping numbers will be an increase over last year most likely.

They do EVERY year since the inflation adjustments the government makes do not accurately reflect the real rate of inflation. Since inflation is understated, the actual amount consumers spend will look higher. I have always said we should look at units sold, not the overall prices paid. Units sold would accurately reflect how much people are buying and not just the inflated prices we see on price tags. If oil continues to stay low, more money will be spent on presents and gifts.

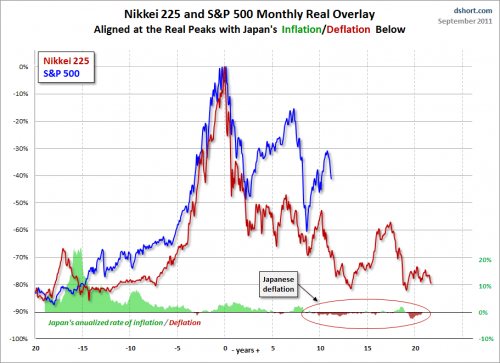

But the government is not interested in telling the truth. It is only interested in convincing you things are fine. Remember, we have a presidential election coming up in under 24 months so the party in office will want to show a healthy growing economy. This is also why I think 2015 will be another up year in stocks barring any unforeseen world implosions. Any upset in 2015 will be aggressively met with Federal Reserve monetary policy at the direction of the White House. 2016/2017 on the other hand will be an interesting year and probably very challenging. The Fed will essentially have little ammo left to address any monetary issues. They will continue as Japan and Europe has done: print up even more money to stave off the deflation left over from the banking blowup in 2009. Look to Japan to see our future.

Considerations for market upsets include ongoing Euro problems which are getting worse by the day, oil issues with Russia and the Middle East and a host of other geopolitical events that can shape which way the world economies go over the short and medium terms.

Japans deflation as well as Europe’s will be met with more QE from their central banks and even China is undertaking this perverted economic remedy, of which a remedy it is not. The US has ceased its QE 3 program but as I predict, it will fire up more QE or something like it probably in the spring. As the bond market slows due to the QE being stopped here (QE means bond buying by the Feds) the markets will not be able to keep rising. Our economy will slow once again just as Japan’s is but for now, the stock market is likely safe to wade in. As always however, limit your exposure to stocks to no more than 30% or so on your entire cash assets. See my DREAM PORTFOLIO for exact percentages and holdings.

Capitalism

Capitalism is a word that spawns many emotions in people of all income levels and social stratas.

Businessmen may look upon capitalism as the panacea to all things economic while others perceive it as the devil incarnate.

As Bill Bonner says in his daily musings from Angora Press: “Capitalism doesn’t always take an economy where it wants to go but it always takes an economy where it ought to be”.

Capitalistic is inherent in mankind and makes itself known in the youngest of humans.

The child in daycare wants his goodies and quickly learns, at least in most households, good behavior will get him what he wants and bad behavior fosters punishment. Hard study in school yields good grades and practice makes perfect. Work hard and practice diligently in sports, and you play more often, get heralded by spectators for your superior play and realize the many fruits of success.

Capitalism also affects even the staunchest of critics.

Those that would destroy capitalism actually practice it in their daily lives, buying things they want with their money and not buying other things that may cost too much. They look at price tags and compare goods, and that dear friend is the essence of capitalism: spending your money on things you want and not spending it on things you don’t.

Capitalism addresses all the things most naysayers complain about.

It does not encourage greed but actually deals with it most efficiently. Simply put, make too much profit on something and capitalism will bring in others seeking to garner a piece of those excessive profits. These new additional players in the market will bring about increased competition which will bring down the price of a good or service. A competitive market place will arise where there once was none. The result is that greed’s gains are effectively eliminated when competition brings profits back to earth.

Capitalism also punishes the inefficient, as inefficient producers have to charge more than the efficient ones and therefore will go out of business if they don’t become more efficient. The efficiency that capitalism produces saves our natural resources. The most efficient producer of goods survives, making more of a product from whatever resource is utilized. The inefficient or wasteful producer finds he cannot compete and goes out of business unless he finds a way to be more efficient.

This “leapfrogging” of technology to stay in business consistently forces man to find new ways to get more out of what we have. The end result is capitalism brings about the lowest price, the highest quality and the most efficient use of our planets resources.

In an nutshell, capitalism is simply the buying and selling of goods by people making their own decisions and then voting on those decisions with their dollars.

Capitalism gets a bad name because those that want to eliminate it (because they misunderstand its true nature) support policies that do away with competition and un-level an otherwise level playing field.

Many are hoodwinked by those wishing to skew the rules under the familiar guise of fairness and equality, when in actuality their efforts cause more inequality and a favoring of certain industries over others which is the exact opposite of what capitalism is.

“Crony capitalism”, where those in power (government) favor or punish certain businesses, is not capitalism at all but the very antithesis of it. Capitalism has no favorites yet crony capitalism is all about favorites: the protected, the subsidized and those that are bailed out. Government is the biggest proponent of crony capitalism (think lobbyist) yet many look to government to control capitalism.

The reality however, is that in most cases, the government destroys capitalism by its taxation, tariffs, regulation and control of free enterprise. Government is pushed to do so by the same people or groups that misunderstand the nature of what capitalism truly is or who simply wish to garner profits through special interest policies forced upon the economy by government.

Capitalism is the exact opposite of control. It is simply the freedom of the people in the market place, and left alone, capitalism would provide the very conditions those that oppose it strive for: a level playing field and opportunity for all to compete fairly with an equal chance of success.

In conclusion, capitalism today is often misunderstood and misaligned with its true meaning. It is blamed for many of the problems we have in the economy.

In truth, the economic problems we see today are because the capitalistic system has been circumvented by government, special interests, social engineering and world improvers, all who simply don’t understand the real meaning of the word and/or by those who seek to gain an unfair advantage in the otherwise near perfect economic system that true capitalism brings about.

---------------------------------------------------------------------------------------------

From the the website SF GATE:

Many Americans consider San Francisco and Berkeley two peas in a very liberal pod — both of them far-left, wacky cities filled with pot-smoking, quinoa-eating eccentrics whose mayoral candidates go by names like Chicken John (San Francisco, 2007) and Running Wolf (Berkeley, 2012).

But there are plenty of differences between the two bluest of blue Bay Area cities. Take a look at most recent election and the very different outcomes for both cities’ attempts to pass a tax on sodas.

Berkeley became the first city in the nation to adopt a soda tax after 30 other cities and states around the country failed. Its Measure D levied a penny-per-ounce tax on sugar-sweetened drinks. Its revenues weren’t pegged for any particular purpose so it needed just a simple majority, but it won the support of a whopping 75 percent of voters.

San Francisco, always a city that loves being first, instead became the 31st municipality to opt not to adopt a soda tax. Its Proposition E would have levied a 2-cents-per-ounce tax, and it needed two-thirds of voters to support it because it would have directed revenue to physical education and nutrition programs for children. A majority of San Francisco voters, 55 percent, supported Prop. E — but that wasn’t enough for it to win.

There was, of course, a lot of Wednesday morning quarterbacking after the election — and a lot of thoughts as to why two such similar cities had two such different outcomes.

If you would like to hear SF gates take on the election and more on this musing

Go to SF gate .com

My take on the soda tax is that it’s another intrusion into our liberty and the rights of free enterprise. It also creates a sticky wicket as the old saying goes. After all, how do you decide what drinks are sodas and what are soda juice blends?

And what about diet soda, if it’s the sugar your after are diet sodas exempt?

What about the new hybrid low calorie half sugar sodas which are hitting the markets?

Are they taxed or just half taxed?

No dear reader, taxing a group of food stuffs that have such a wide variety of versions is bad medicine as is any targeted food taxes. I think as adults we can decide what foods we buy and don’t need to pay more because some have a sweet tooth.

What’s next a special tax on candy?

Super Dividend Payers List

I am so excited about the new update to the Super Dividend Payers List I just put on my website! This list has always had great dividend payers on it, many of which I own or have owned myself for years but this latest version has some great stocks I have found which you should consider right away. I have arranged the list so the first 60 stocks are in order of importance as I view them!

The first few are money generators and the Giants of the Midway as I call them.

Let talk about the FIRST stock on the list. (I made this super easy! Just get the list and look for the first one listed!).

This company owns over 95% of its market! It is valued at over one tenth of a TRILLION dollars! Talk about HUGE!

Its spews cash like an uncorked fire hydrant!

It has a balance sheet like Fort Knox and generates tens of billions in profits and has for decades. I bet you use this product everyday as almost every person on the planet does whether they know it or not! It has increased it R and D spending despite its complete dominance which tells me it’s not sitting on its heels!

It pays a healthy dividend compared to other companies of this size. It has beaten almost all the Dow stocks in performance and this year rose over 30 %!

You know this name yet few own it. That should all change once you get the list!

It’s paid a dividend for over 30 years and right now yields gobs more than a savings account. The real jewel in the crown is it’s been a few years since it raised its dividend and some experts think it’s about to do so in short order and by A LOT!

What makes this money pot even sweeter is the company is planning to buy back almost 1 in 10 of its outstanding shares within a year or so and at today’s prices it will spend somewhere in the neighborhood of 20 billion dollars to do so! When a company buys back its own shares it means less shares on the market and that mean profits as shares likely rise! They may even buy back the shares you hold (if you dare want to sell that is!).

It also shows us that management thinks its own shares are a deal! What a better vote of confidence could there be! Again, it is the first stock on the new UPDATED SUPER DIVIDEND PAYERS LIST just out this week!

The second stock on the list is one I have recommended to friends and family alike. It’s also a MONSTER of a company and again, odds are you interact or use this product every single day in almost everything you do. It has oodles of cash and the very best of ratings of any company on the planet. It gushes cash and owns its market. It one of the best stocks I can recommend and is usually the FIRST stock I have anyone buy! It is listed second on my list and if you buy BOTH you will own the finest of companies on Earth and both pay you to hold them!

The 3rd company is a leader in their field and caters to the “must have” area of human existence - ENERGY. They don’t make it however as that can be very risky. What they do is GET IT for others! The company has great market dominance and a solid balance sheet. The BEST part of this company is because of world circumstances; its share price has been PUMMELED! Don’t let that fool you however. That pummeling means a great deal for us!

Right now it sports an eye-popping dividend of close to 10% a year! 10% compounded means money doubles in 7 years! WOW. Considering this stock was up around 90 buck a share and it now sits at 30, it has a super PE ratio of about 6! That’s dirt cheap compared to Amazon which has a PE of over 800! Wow, talk about a deal!

This company is worth 11 billion according to its current price but think what is was valued at when it sat at 90! I think so much of this stock I bought some for my 89 year old father and my best-est of friends!

The next stock on my list (#4) is a drug company that owns multiple patents and the most commonly drugs. It’s a leader in its field but it’s also been beaten up due to what I deem as temporary setbacks. I love beaten up stocks as they can go up again AND pay you huge dividends while we ride! Its pays a 5.7 % dividend and has a cheap Price to earnings ratio of 14. Another blue light special and the 4th on my Super Dividend Payers List.

One more thing: being in the pharmaceutical business, the Ebola scare could send this companies stock soaring!

The next two stocks are just as monstrous and a must have in any solid portfolio. #5 has been around for over 60 years with a 35 billion market cap. Its dividend growth has been superior and is ranked in the top 4 of the strongest companies as rated by the top rating agencies. #6 is another of the best run companies in the world and has an arsenal of products used every day worldwide. Both of these companies are the best of the best and companies you never sell! Just collect the checks!

My list has sported solid payers for years. The first 60 or so on the Super Dividend Payer List sit among the world’s finest of companies and if you haven’t heard of every single one of them, I would be VERY surprised. I KNOW you have used their products in your everyday lives though!

Right now stock picking is tantamount to profits. Today’s markets are not the buy and hold markets you are taught. I have said since about 2011 you should only own about 10-20 % in stocks and only hold the biggest and baddest companies on the planet.

The first 60 or so ARE those companies!

For the price of a dinner out, you can own this list for you and your family to use. My own father uses dividend payers for his daily income and makes over $3000 a month JUST IN DIVIDENDS from some of these same companies!

This market is not for your average everyday mutual funds nor your small, speculative stock picks. It is a market where you should only own the most defensive of stocks in the biggest and safest of companies!

That’s why this list was developed. Sure there are some high flyers on the list and I usually (at least right now) only recommend the first 60 or so but I have stocks and funds on the list which pay 10, 11, 12, 13, 14, 15 and even 16 % in dividends a year! If you need even more income and can tolerate risk, there are many of these ultra-high paying stocks and funds to select from.

Of course, no one can guarantee which way any stock will go or whether they will raise, lower or cut their dividend and I can’t either, but most of these first 60 or so are names you know of and whose products you use. The smaller ones you may not have heard of but the returns you will LOVE.

Get on the fast track and start seeing checks in your account instead of fees that rob you and your family of your hard earned income. See the list I use. See what I own and buy for my own family and friends. Get started today by clicking here to get my SUPER DIVIDEND PAYERS LIST. You can buy the list outright or better yet, for a few dollars more, sign up for website membership and get all my updates to this list and my others portfolios AND the entire series of Money Matters topic shows for 2 years! I will even give you one year FREE with a two year subscription! That’s makes 3 years of the most complete coverage and analysis of the markets and your money!

If you already are a member, you get the updated list for FREE as a paying member!

Download it today! If you are not a member, become one now!

Don’t delay. Click here and start cashing checks and get these monster dividend payers before everyone else starts discovering these hidden jewels and drives their stock prices up, up and away.

CLICK BELOW or paste on your browser:

http://moneymanagementradio.com/cart/super_dividend

Stay tuned and as always, I am constantly scouring the planet for the safest and most profitable investments for all of my fans! Keep tuned and keep the faith.