Money Matters 200th Anniversary Show airs December 4, 2014 New Update- Please Read

Money Matters airs today at noon PST on KVMR FM or WWW.KVMR.ORG.

The 200th Anniversary Show.

Marc's Notes:

I covered what is called the carry trade a few times here on Money Matters but this unique Wall Street money cocktail is reaching new heights so it’s time to inform our as to what is the Carry Trade, how it works and why big time investors do it.

I say big time investors because its not the sort of thing Mom and Pop investors usually do. Although I suppose it is possible on a small scale but probably not very practical in its implementation by individuals.

The carry trade is when an investor borrows money from one source and invests it in another source that pays more.

For instance, the interest required for borrowing money from the Federal Reserve or the Bank of Japan (if you borrow yen) is extremely cheap. We are all aware that interest rates are very low right now and it’s low in Japan as well as in the US.

Since it’s relatively cheap to borrow money from the Fed or Japan due to these low interest rates, investors borrow huge amounts of US dollars or Yen and then invest those borrowed currencies in higher paying assets like stocks, bonds or questionably rated sovereign debt (think Greek bonds) in order to get a high return.

If it costs one percentage point to borrow a billion yen, then if you invest that billion yen in an asset paying a 3 % return, these huge investors pocket the difference which would be two percent. Two percent may not sound like much but if you borrow ten billion dollars two percent profit is 200 million dollars.

Not bad for a day’s work of banking. Up the amount borrowed and the profits only increase from there.

This carry trade is encouraged by low interest rates and those interest rates are driven low by the central banks of the world. The central banks know low rates encourage the carry trade but they do it anyway. This is basically free money to the banks, as the more they borrow the more they make.

There is a danger here and it’s a very big one, in fact one of the largest dangers.

If the interest rises on the money the banks borrowed due to an unexpected event, the profit can slam in reverse and one could lose that 200 million just as easily. With larger amounts, the losses of course get larger as well.

An unexpected rise in interest rates is just that, unexpected, so although the big money players don’t expect rate to rise enough to get them in serious trouble, if rates do rise suddenly and by enough, the big banks could find themselves in big trouble once again, driving the world economies toward the abyss we saw in 2008 and 9.

The fact that literally trillions of dollars is now involved in carry trades worldwide, the risk is a real and dire one. In spite of this enormous threat, the central banks who oversee this type of trade keep interest rates low which encourage the trade and then stand idly by doing nothing to police it.

Like the previous crisis, should the big money players get into serious trouble with the carry trade, the central banks will then use public money (your money) to bail them out again, all the while saying the bailouts are to stabilize the system.

No forethought of PREVENTING the crisis by normalizing rates or overseeing these large bets apparently enters the minds of our monetary authorities or Washington. Its only business as usual until that business turns toxic and then they will use our money to make the banks whole again then probably do it all over again, again.

-----------------------------------------------------------------------------------------------------

The markets up then down but the general direction is up. Meanwhile oil is slammed under $70.00/ BRL and my call that the slide would halt around $80.00 or so is not coming true as of yet. It has slid a bit farther then where I anticipated but I still think oil will not stay down here for long.

Putin of Russia is getting hurt with prices so low and the Saudis are not too happy about it either. The Saudis said last week they will not cut production which caused a further slide in prices. Putin today is ramping up the rhetoric and knowing how this tyrant is,

I believe he will do something to cause oil prices to rise soon. The democratic governments of the world may have allowed oil to fall to punish Putin but as usual, they go too far and unforeseen ramifications are taking place like they do when governments try and manipulate free markets.

On the plus side, consumers have more money to spend which should help the economy, and lower oil prices are making Putin think about his aggressive policies.

On the downside, US oil and shale companies are now in a head to head battle with the Middle East on who can weather the falling prices and still produce oil. Big oil is now hurting and it remains to be seen how many will go to Washington to try and convince the bureaucrats to halt the slide. Many smaller producers will not be able to survive if oil stays low and the bigger companies will start acquiring them at fire sale prices.

Consolidation is the word of the day here.

More concerning is that the low oil prices are causing deflation in many things (falling prices) and if you recall from previous newsletters, the central banks are deathly afraid of deflation. With the falling oil prices has come falling gold and commodity prices.

This is very deflationary and is starting to drag down prices across the board (deflation).

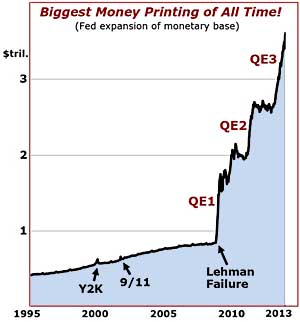

I expect a concerted effort from democratic governments to first get the price of oil to stop falling. I also expect more QE from Europe first, then the US will follow suit if the European QE doesn’t stop deflation. The Euro countries are hurting and what once was thought a good thing (falling oil prices) is now turning out to be working against their plan to foster inflation. Be careful what you wish for.

For now the US economy is still expanding so drastic moves are not expected but count on more talk from central banks on the subject of deflation and slowing economies. Action on their part may not be today or tomorrow but it is coming.

Retail sales from the Thanksgiving weekend were horrendous and major news outlets conjured up the excuse that Thanksgiving Day sales cannibalized Black Friday figures.

I think this has some validity but I also think that the consumer is hurting. Real wages just haven’t kept up. QE has boosted markets and asset prices but has not helped real wages for the common man. THIS is the caveat of QE and my prediction for years. QE does not work for the most part. It only causes slow inflationary bouts which hurts pocket books, then the rebound effect when QE stops is a further erosion in prices, exactly what we are seeing now. Waves of QE followed by its cessation which is followed by a slowdown (where we are arriving at now) followed by the necessity for more QE (where we will be in a few months).

For now, expect some stock volatility followed by more slowing followed by central bank action, first starting in Europe on a grander scale.

All this adds up to opportunity for us! Oil dividend paying stocks are on sale! A few have been falling horrendously and I will watch those for you, but oil is not going away.

It will rebound! For the best buys in dividends payers, I refer you again to the Super Dividend Payers List below! If you haven’t taken advantage of it, do so now! For the price of a few beers, you can own it. Read below and don’t forget to tune in December 4th at noon, PST.

Marc

-------------------------------------------------------------------------------------------------

Super Dividend Payers List

I am so excited about the new update to the Super Dividend Payers List I just put on my website! This list has always had great dividend payers on it, many of which I own or have owned myself for years but this latest version has some great stocks I have found which you should consider right away. I have arranged the list so the first 60 stocks are in order of importance as I view them!

The first few are money generators and the Giants of the Midway as I call them.

Let talk about the FIRST stock on the list. (I made this super easy! Just get the list and look for the first one listed!).

This company owns over 95% of its market! It is valued at over one tenth of a TRILLION dollars! Talk about HUGE!

Its spews cash like an uncorked fire hydrant!

It has a balance sheet like Fort Knox and generates tens of billions in profits and has for decades. I bet you use this product everyday as almost every person on the planet does whether they know it or not! It has increased it R and D spending despite its complete dominance which tells me it’s not sitting on its heels!

It pays a healthy dividend compared to other companies of this size. It has beaten almost all the Dow stocks in performance and this year rose over 30 %!

You know this name yet few own it. That should all change once you get the list!

It’s paid a dividend for over 30 years and right now yields gobs more than a savings account. The real jewel in the crown is it’s been a few years since it raised its dividend and some experts think it’s about to do so in short order and by A LOT!

What makes this money pot even sweeter is the company is planning to buy back almost 1 in 10 of its outstanding shares within a year or so and at today’s prices it will spend somewhere in the neighborhood of 20 billion dollars to do so! When a company buys back its own shares it means less shares on the market and that mean profits as shares likely rise! They may even buy back the shares you hold (if you dare want to sell that is!).

It also shows us that management thinks its own shares are a deal! What a better vote of confidence could there be! Again, it is the first stock on the new UPDATED SUPER DIVIDEND PAYERS LIST just out this week!

The second stock on the list is one I have recommended to friends and family alike. It’s also a MONSTER of a company and again, odds are you interact or use this product every single day in almost everything you do. It has oodles of cash and the very best of ratings of any company on the planet. It gushes cash and owns its market. It one of the best stocks I can recommend and is usually the FIRST stock I have anyone buy! It is listed second on my list and if you buy BOTH you will own the finest of companies on Earth and both pay you to hold them!

The 3rd company is a leader in their field and caters to the “must have” area of human existence - ENERGY. They don’t make it however as that can be very risky. What they do is GET IT for others! The company has great market dominance and a solid balance sheet. The BEST part of this company is because of world circumstances; its share price has been PUMMELED! Don’t let that fool you however. That pummeling means a great deal for us!

Right now it sports an eye-popping dividend of close to 10% a year! 10% compounded means money doubles in 7 years! WOW. Considering this stock was up around 90 buck a share and it now sits at 30, it has a super PE ratio of about 6! That’s dirt cheap compared to Amazon which has a PE of over 800! Wow, talk about a deal!

This company is worth 11 billion according to its current price but think what is was valued at when it sat at 90! I think so much of this stock I bought some for my 89 year old father and my best-est of friends!

The next stock on my list (#4) is a drug company that owns multiple patents and the most commonly drugs. It’s a leader in its field but it’s also been beaten up due to what I deem as temporary setbacks. I love beaten up stocks as they can go up again AND pay you huge dividends while we ride! Its pays a 5.7 % dividend and has a cheap Price to earnings ratio of 14. Another blue light special and the 4th on my Super Dividend Payers List.

One more thing: being in the pharmaceutical business, the Ebola scare could send this companies stock soaring!

The next two stocks are just as monstrous and a must have in any solid portfolio. #5 has been around for over 60 years with a 35 billion market cap. Its dividend growth has been superior and is ranked in the top 4 of the strongest companies as rated by the top rating agencies. #6 is another of the best run companies in the world and has an arsenal of products used every day worldwide. Both of these companies are the best of the best and companies you never sell! Just collect the checks!

My list has sported solid payers for years. The first 60 or so on the Super Dividend Payer List sit among the world’s finest of companies and if you haven’t heard of every single one of them, I would be VERY surprised. I KNOW you have used their products in your everyday lives though!

Right now stock picking is tantamount to profits. Today’s markets are not the buy and hold markets you are taught. I have said since about 2011 you should only own about 10-20 % in stocks and only hold the biggest and baddest companies on the planet.

The first 60 or so ARE those companies!

For the price of a dinner out, you can own this list for you and your family to use. My own father uses dividend payers for his daily income and makes over $3000 a month JUST IN DIVIDENDS from some of these same companies!

This market is not for your average everyday mutual funds nor your small, speculative stock picks. It is a market where you should only own the most defensive of stocks in the biggest and safest of companies!

That’s why this list was developed. Sure there are some high flyers on the list and I usually (at least right now) only recommend the first 60 or so but I have stocks and funds on the list which pay 10, 11, 12, 13, 14, 15 and even 16 % in dividends a year! If you need even more income and can tolerate risk, there are many of these ultra-high paying stocks and funds to select from.

Of course, no one can guarantee which way any stock will go or whether they will raise, lower or cut their dividend and I can’t either, but most of these first 60 or so are names you know of and whose products you use. The smaller ones you may not have heard of but the returns you will LOVE.

Get on the fast track and start seeing checks in your account instead of fees that rob you and your family of your hard earned income. See the list I use. See what I own and buy for my own family and friends. Get started today by clicking here to get my SUPER DIVIDEND PAYERS LIST. You can buy the list outright or better yet, for a few dollars more, sign up for website membership and get all my updates to this list and my others portfolios AND the entire series of Money Matters topic shows for 2 years! I will even give you one year FREE with a two year subscription! That’s makes 3 years of the most complete coverage and analysis of the markets and your money!

If you already are a member, you get the updated list for FREE as a paying member!

Download it today! If you are not a member, become one now!

Don’t delay. Click here and start cashing checks and get these monster dividend payers before everyone else starts discovering these hidden jewels and drives their stock prices up, up and away.

CLICK BELOW or paste on your browser:

http://moneymanagementradio.com/cart/super_dividend

Stay tuned and as always, I am constantly scouring the planet for the safest and most profitable investments for all of my fans! Keep tuned and keep the faith.