Money Matters Update- February 28, 2015 READ

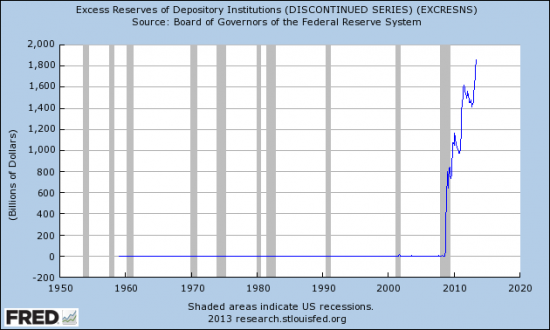

The soaring balances at the central banks are actually a gauge of toxic debt they bought from private banks to make them whole again.

Marc’s Notes:

An upcoming Money Class is happening soon. As soon as I get a date, I will post it here on the newsletter. The Money Class is about investing, what to avoid and what to buy, how to audit your financial advisor and your holdings, the ins and outs on real estate today, what stocks to hold, bonds, and other investments. Gold and silver will also be covered as will annuities, offshore possibilities, where the markets will go from here and just about everything you need to know to protect and grow your money. This is “must attend” class lasting about three hours and a question and answer period will conclude the class. 25 % off to all who email me now they want to attend.

Market notes:

Greece got another can kick on their debt. Read below:

The recent decade has brought the word bailout to light and plainly put “bailout” means central banks print money and buy debt that no one else will buy.

They use the words “to stabilize the system” and since no one individual is big enough to upset the system, bailouts only go to institutions: those evil corporations you all know and love and mainly the banks of course and Wall Street firms.

In any case, we have been witness to repeated bailouts of all sorts of institutions over the past ten years, the most recent being overseas in Euro land where the European Central Bank has bought Greek debt (among others) because a lot of countries of which include Greece, borrowed way too much money and now can’t pay. Greece itself is on its third bailout and if we take a look at where the money actually went that the European Central Bank printed up, the realities become about as bleak as can be for the average Joe but money waterfall for our old buddies the banksters.

Greece today has received about 300 billion dollars in bailouts and about 92 % of that went to financial institutions while a mere 8 % went to the actual people of Greece.

Ponder that around in your brain for a minute dear reader. Out of about a third of trillion dollars in bailout money and the Greek people only got about 30 billion or so while the banks received all the rest.

Now keep in mind the people of Greece did little to cause the economic train wreck they find themselves in today yet they paid for it in massive unemployment and a very sick economy. Meanwhile those financial institutions that got all that bailout money (and will continue to do so) speculated on debt of all sorts and then kept the profits from such speculation. Yet when some of the bets went bad, they received almost all the money.

The banks made the bets, profited from those bets and gave none of those profits to the people. When the bets went bad, and economy suffered, so did the people, who got little help, while those responsible for the blow up got to keep the profits then, adding insult to injury, get the losses covered with profits to boot.

If you think the Euro bailout is any different than any other bailout, you have another thing coming. All the bailouts coordinated by central banks everywhere give money to the same financial institutions that cause the financial train wrecks that necessitated the bailouts in the first place, while the people pay for it all in lost jobs, lost homes and economic malaise.

Unfortunately for us, it’s the way things work in banking circles and in the world of central bankers. The question is why do we put up with it?

Negative Yields:

Going negative is not a term suggesting you shed your clothes and romp through the jungle looking for wild boar to eat.

Going negative is when you loan someone money and when they pay you back, they give you less then you loaned them and pay you no interest to boot. This is known as a negative yield.

An example would be you loan someone a thousand dollars and they use it for a year, and pay you $990 dollars to settle the loan. Going negative means just that. Instead of earning any interest on your money, you actually get back less than what you loaned out.

Why would anyone do this?

Although it sounds like a raw deal and only for the galactically stupid, many large institutions are doing just that, loaning out their money for negative yield.

This “going negative” is a rare occurrence but recently it is becoming far more common than you might imagine.

In our world of falling interest rates, where even our central bank, the Federal Reserve has dropped interest rates to almost zero and you get next to nothing in a savings account, many countries are now offering to borrow money for no interest and repay less than the original amount.

The thinking is interest rates will not rise because the economies of the world are hemorrhaging cash and things might get even worse than they are now. With billions in manufactured cash from all the Quantitative Easing (QE) programs around the world, and most of that money going to financial institutions, these institutions need massive hiding places to invest that money and even loaning it out at a slight loss is better than risking even bigger losses in ailing stock markets. Another concern is loaning money to financially strong countries or institutions at least insures you will get your money back and in a world where defaults and bailouts are the norm, getting 99% of your money back is better than losing it all.

How prevalent are negative yields?

85% of the 346 securities in the Bloomberg Eurozone Sovereign Bond Index have negative yields, data compiled by Bloomberg show.

Germany recently sold five-year notes at an average yield of minus 0.08 percent on Wednesday, a euro-area record, meaning investors buying the securities will get less back than they paid when the debt matures in April 2020.

As odd as this is, the thing we should take away from all this is: what is this saying about the perceived safety and recovery of our world economies?

Although monetary authorities everywhere assure us everything is fine and under control, the public debt markets where these negative yields are the reality is telling us something quite different.

Audit the Fed:

The Federal Reserve is a non-elected body of officials that control our money supply and our interest rates. Not that I agree with that mission but that it does do those things is undisputable.

Established in 1913 by a private group of banks and very opaque in its operations, the members nor its chief are not publically elected. Following in the footsteps of Amchel Rothschild’s quote: “give me control of a nation’s money supply and I care not who makes it laws”, the US federal reserve is arguably the most powerful institution on the planet.

Seeing as it does have enormous power and controls the largest amount of money on the planet, you would think the American people would have the right and insist to that right to know just what the heck these guys do, how they do it and to whom they give OUR money to.

Such is not the case today as the Federal Reserve operates mostly in the dark, not only to us but to most of our elected officials as well.

The various attempts to audit this institution have to date mostly failed except for a one time disclosure forced upon it after the ‘09 crisis that revealed where all that money went.

That disclosure was a mind-blowing reveal showing billions went to hundreds of institutions, foreign and domestic, with, among many other stunners, a whopping 700 billion or so going to our 5 largest banks in exchange for toxic mortgages they could not sell. There is no plans to pay any of this money back mind you and it wont be.

That one time disclosure and what it contained should have been enough to teach us the Federal Reserve should be audited and the American people should know exactly what this institution does. It is after all our money.

There is pressure to audit the Fed and movements in Washington to do just that are happening now but the audit is being resisted by Fed Chief Janet Yellen and a host of policy makers on the hill. Mostly democrats, the reason for denying an audit is the excuse it would make the Federal Reserve political and therefore subject to political wills. Not that it isn’t already but that’s the story and their sticking to it.

That Fed Chief Janet Yeller resists the audit is a no brainer. The more she can do without scrutiny, basically the more she can do, but for our elected officials to resist our wanting to know what the Federal Reserve does is baffling to say the least.

Most Democrats and some Republicans want to block the audit as apparently so does the white house.

One of President Obama’s top economic advisers said he opposed “dangerous” legislation that would give lawmakers closer scrutiny over Federal Reserve deliberations.

Jason Furman, chairman of Obama’s Council of Economic Advisers, called pending legislation subjecting monetary policy deliberations to outside review “somewhere between superfluous and highly counterproductive.”

He added that he would encourage President Obama to oppose the bill if it reached his desk.

So much for the promise of having a more transparent government and Federal Reserve.

No matter what the outcome of an audit the Fed bill, I think most Americans would support this attempt to know what these most powerful people of the Federal Reserve do.

That the White House, a majority of Democrats and even some Republicans don’t want us to know is perplexing at best.

Other happenings:

Actor Leonard Nimoy died (Mr. Spock). . I am a big fan of Star Trek. Live long and prosper.

Gold and silver look good after halting a pullback that might have gotten ugly should it have continued. Next week will be interesting to see if it can continue to climb past $1300/ Ounce (gold). Silver will likely mirror the direction of Gold. For a list of gold stocks and funds I added or will add soon get the Free Gold Report with any new 2 year subscription to moneymanagementradio.com. We will see your order then email you the report. We also give you the 3rd year free! A super value!

Loyal followers of Money Matters know I am not a big fan of bonds except short term government bonds and maybe a small holding of muni’s in non- IRA accounts and a small amount of AAA rated bond funds. Now Goldman Sachs Group Inc. says fixed-income investments have become dangerous.

“The risk in bonds has gone up,” Francesco Garzarelli, London-based co-head of macro and markets research, said in an interview on Bloomberg Television’s “The Pulse” with Francine Lacqua and Guy Johnson. “The sensitivity to small changes in yield expectations from here will command very sizable price swings, and I just think that makes fixed-income a very dangerous asset class.”

I agree.

Our dividend payers continue to pay and many are reaching new highs. Hold and add according to my Dream Portfolio. (SEE WEBSITE TO GET THIS REPORT). For the list of stocks paying dividends, see my Super Dividend Payers List also on the site.

I did a news piece and article on sector rotation. Certain industries come into favor and others go out of favor. Right now defense contractors, biopharma and solar among a few other groups appear to be in favor, with solar just beginning to look like it is turning up.

Biopharma and defense contractors have been on a tear already. Gold and silver look to be turning favorable as previously mentioned. The Euro currency looks to rally and the US dollar looks to fall but this is data dependent and based mostly on a

contrarian” view. Most everyone expects the dollar to continue up and the Euro to fall so I am betting the other way with a small position in each through options.

Oil stocks continue to be the wild card and a lot of money may be made in oil if not right away, over the medium to long term.

Tesla looks to continue to fall and Alibaba should turn up soon but again these are only guesses based on chart analysis. Apple is another wild card. I hold it long term but since it has done nothing but go straight up, I sold some to wait and see what happens. The I Watch event is in 2 weeks so a brief pop on that may take place. I like Apple long term as it does pay a dividend and is the largest company by market cap in the world.

I am looking into managing assets for a financial advisory firm and meet on that this week. If we reach an agreement I will forward the firms name to you for those wanting someone to actively manage their portfolio.

Stay tuned to Money Matters, get your website subscription, and tune in this Thursday at noon PST as I broadcast from our new digs at KVMR.

All the best,

Marc