Money Matters airs January 5, 2017 at NOON PST

Hey kids, tune in Thursday for the start of the new year 2017 with a noon Money Matters show!

Pacific Standard time that is! Hear what might be coming, some car news and how you might buy one, and a whole bunch of other great market stuff to listen to~

Call in with your questions anytime during the show at (530) 265-9555 and ask live on air

Talk to you all tomorrow and enjoy reading below!

----------------------------------------------------------------------------------

NOTE: I am doing research for a report/article on senior housing availability in Nevada County. If you or someone you know lives in a rented apartment of the Senior Living type in our county, whether it is unassisted or assisted, please contact me. I have a few quick questions I would like to ask~

-------------------------------------------------------------------------

“It’s not what you do with success that makes you successful but what you do with failure. Anyone can succeed and celebrate a win, but it’s what you do when you fail that separates a winner from a loser and makes us that much better in the end. This is the defining difference between those that are successful and those that are not”

---------------------------------------------

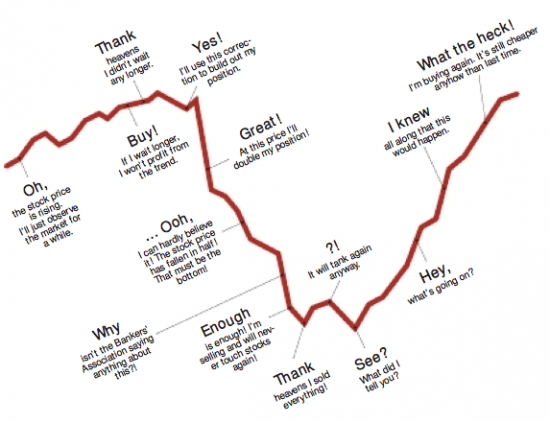

Losses and negative balances when they occur can be an unwelcome aspect of investing but they can actually tell us a lot about what kind of strategies are being used and whether they are appropriate for a particular investor’s situation.

In my humble opinion, the words of famous investor Warren Buffet apply first and foremost:

“Rule No. 1: never lose money; rule No. 2: don’t forget rule No. 1”.

Investors would be prudent to heed such advice. Limiting losses when the market moves against you is more important than how much you make in up markets.

Looking at the percentage amount of your losses in down markets may be an indication of how much at risk your portfolio might be. On the flip side, how much you make in up markets also can indicate the level of risk.

Suppose an investor sees a general market increase of 50% and his portfolio moves up by the same amount or even exceeds the percentage and gains even more. The investor is thrilled and perceives the strategy a sound one and that he or his advisor is a genius.

Standing back and analyzing that result with more thought however may yield a different opinion.

If the portfolio rises in lockstep with the market, it could also fall in lockstep. In our example, a 50% gain may feel great, but if the market falls 50%, would a 50% loss in your portfolio feel as good?

Probably not. Most investors I know would not tolerate such a setback. A 50% loss is a gigantic hole to dig out of. To recover from such a loss would then require the market to double from the lower level due to the math involved just to break even. Many investors might think the market only has to recover 50% from such a loss but a rise of 50% gain from the lower level would still yield a 25% loss.

A portfolio that moves up in lockstep with the market may mean you are over exposed for your level of comfort should the market move against you.

A more conservative approach may mean you make less in up markets but you also won’t be subject to violating rule No. 1 as badly.

Think back to the markets of 2009. Many investors took losses in the double digits and some lost significant amounts and still haven’t recovered. Had the losses been limited to single digits however, recovery is much quicker and a lot less stressful.

If you are seeing huge profits in your portfolio in up markets, that may indicate a level of exposure you may not be comfortable with once the markets move against you. Generally speaking, a more conservative approach will mean you won’t make as much when markets run, but it also means you won’t lose as much if markets fall.

Portfolios that don’t move much may not seem as exciting or rewarding as your neighbors portfolio at times, but it may mean you will sleep a lot better than he will if the tide of markets rush out unexpectedly.

Portfolios that grow slowly over time but keep losses at a minimum when they inevitably occur, could help to keep rule No.1 at bay.

Heavy concentrations in stocks to gather fast gains may be enticing but there was a reason the tortoise beat the hare. Slow and steady may be the order of the day when it comes to long term investing and living within your risk tolerance level.

----------------------

"Size up your shot or just hit away"

Do you plan your shots or just step up and whack it? Some might call it winging it, others shooting from the hip. No matter what the label, we all know what it means. In life we have two choices, or at least during most times we do. The unforeseen event may hit us without warning leaving us no time to prepare, but even in an event such as this, we may have had to opportunity to plan what happens to us. Our two choices entail sizing up our trajectory, our hopeful flight path and desired end result or not planning at all and hope for the best. We can even prepare for the unexpected in many cases. How and what we plan, and even if we do plan at all are all conscious events and have a bearing on what the final impact or result may be. Wearing seatbelts is a preparation of sort: preparing for the unavoidable. Using insurance is preparing for the undesirable and planning ahead in business and in life is hopefully affecting how successful we are. There are many ways to prepare but in most cases only a few ways are the right ways. Many people prepare incorrectly and some don't prepare at all. Hence the men are weeded out from the boys and successful rise above the rest. The proverbial cream at the top. Knowing how to prepare is tantamount to success for if one knows not what questions to ask, it will all be for naught. Whatever your undertaking, if you are not sure or new to whatever quest you may seek, ask someone who has been there or has the knowledge required for whatever it is you are striving for. Failure should not be an option. It can wipe out your dreams, your pocket book, or even your life. When you are ready to step up the tee and whack one, your first move should be to step back and prepare. Survey the landscape and do all things you can to insure a successful shot. Then get up there and knock it out of the park!

Jambo till air time!

Marc