Money Matters update August 8 2022

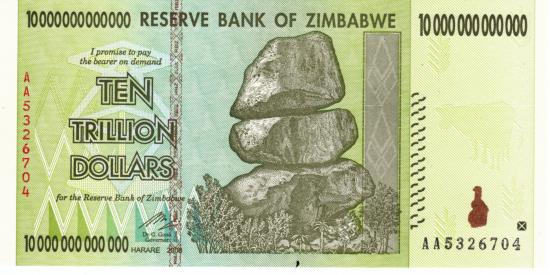

Is the US dollar headed for 18 zeros ?

Hello Money Matters fans,

With the market continuing to jerk investors to and fro, even with the recent increase in market up days compared to the first half of the year, many are looking for safe havens until the market becomes more stable.

U.S. Government “I-Bonds” from Treasurydirect.gov are paying an annual yield of close to ten percent right now and was covered in a previous Money Matters article so I won’t cover them again here.

Regular treasuries and CD’s can be bought at your local bank, credit union or brokerage house, although the interest rates are still anemic even with the Federal Reserve on an interest rate increase binge of late.

In searching for higher yielding yet safe investment vehicles from our brokerage house where we handle our accounts, the fixed income department gives direct access to CD and U.S. treasury screeners where I can view current rates and different quantity solicitations directly from such dealers.

For instance, when I go to my U.S. Treasury screener, I can see a variety of dealers offering up their treasury quantities and rates. Each dealers offering can be slightly different than the next.

Surprisingly, three, six and nine month Treasuries were offering yields north of 2%. The longer out one went, the higher the yield. The Cd’s offered on this dealer screener were equally surprising in their yields.

I, like many investors, have become used to the near zero rates banks will pay on short term savings accounts, U.S. debt like Treasury bills, bonds or notes, and money market funds. We may just assume the returns on such short term monetary commitment vehicles are paying next to nothing, and for years we may have been right.

Surprisingly, and refreshingly, by accessing direct into my brokerage firm’s dealer screen, those perceived “non-existent” or paltry rates from banking institutions are becoming somewhat of a mirage. They aren’t so paltry anymore.

Rates are actually becoming palatable, at least to this analyst, and even on short term financial instruments like Treasuries and Cds, and on instant access accounts like savings or checking, rates are rising.

Will miracles never cease…

In checking www.bankrate.com, one of my favorite comparative websites for bank rates on all sorts of financial products like Cds, Treasuries, savings and checking accounts, at first glance, the rates appear to be lower than what I can access through my dealer screener at my advisory broker.

Although financial service companies like advisors and brokers are usually sought out for stocks and bonds, I was pleasantly surprised to see not only could I buy these “bank” type products mentioned above, the rates I was seeing were comparatively very attractive.

Thank goodness I looked right?

The whole point of today’s musing is to illustrate interest rates have likely risen at your local bank and credit union, like they have at most all financial institutions. This is because of the Feds recent war on inflation. To help combat it, they are increasing interest rates.

These ongoing rate increases by the Fed have also helped increase bank product rates. That means savings and checking accounts, along with a whole slew of other typical bank offerings are likely paying higher rates then we remember.

Making a good thing even better, inquiring at your local financial advisor office about such investments that are typically bought at a bank might mean even higher rates are available there.

I was surprised to see the dealer markets our brokerage firm had access to might be offering what appeared to be even higher rates than I found elsewhere.

Only goes to show that, in these crazy times, continually circling back to what was thought to be once stale financial fishing grounds might surprise to the upside if we take the time to inquire.

Revisiting what we once thought was the mundane may not be so boring after all.

And Lord knows our pocket books could all use a little more stuffing in them.

Marc was recently voted Best Financial Advisor in Nevada County. 530-559-1214

Turning 65?  Call me!

Call me!

(530)559-1214