Money Matters Update October 5 2024

Her plan: Serious economics or other?

Keep reading.

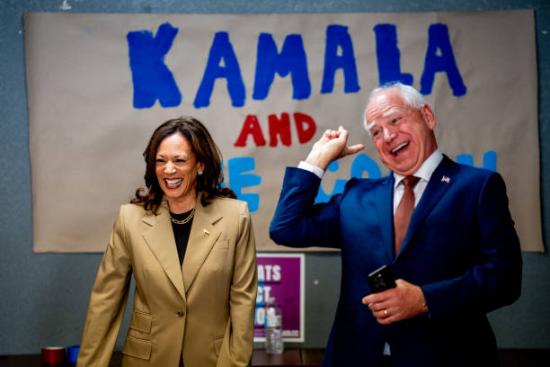

Vice President Kamala Harris last week revealed a rough draft of her economic plan should she be elected to President. She promised to prioritize the proposal in her first 100 days in office.

This is the first economic focused address since she moved into the candidacy and it aims at reducing costs to the American consumer. The outline includes a ban on corporate price gouging to lower the cost of groceries and prescription drugs. These proposals sound good on at the outset but if it was that easy to convince corporations to lower prices, how come Harris and Biden don’t do it now. I mean, why wait, right? My opinion is that this might be an exercise in futility but it sounds good.

Affordable housing is on the ticket. That again is a large free market and large free markets can’t be bent easily. Lowering interest rates will help lower payments so she could jawbone the Federal Reserve to lower them but the Fed is supposed to be independent. Both she and I know of course it is far from that so as President, she could definitely put the screws to Fed Chief Jerome Powell. Her plan is looking at a first time buyer home credit. This strategy has been tried a few times in the past and may have contributed to the real estate bust, but if you want to get people into their first home, these credits would definitely help. I would add to make sure those getting those credits have good credit themselves and Harris had mentioned that in her proposal.

On food prices, contrary to popular belief, food companies and the stores that sell food operate on very thin margins. They basically make their profits on volume. Not sure there is much to be done there. Drug prices are definitely expensive and the Biden administration just came out with a new edict lowering prices on some popular and much needed medications. Harris could continue down those lines.

Tax code changes are on the menu. Tax code changes require house cooperation so that could be a sticky wicket. Expanding child credits and the like do go through a little easier so Harris could push for even more help in that arena.

Of course, much of this requires more spending. That means more borrowing by Uncle Sam and higher taxes for some. Without seeing specific proposals and their details it’s difficult to comment on the ability of the government to fund some of these programs. Like all on the campaign trail however, it’s easy to say what you are going to do, but it’s not as easy doing it.

One thing we can be sure of, whoever gets the nod for President, both sides plan on, or will end up spending a ton more money we Americans just don’t have. With the U.S. 33 trillion in the debt hole and climbing (no one really knows for sure), more social programs will run up deficits and thereby run up the interest payments the U.S. has to pay on that debt.

And of course, more money flowing out of Washington means more inflation, and don’t we have enough of that now?

The jury is still out on the Harris plan at this point in time. We just don’t know the details on how she would accomplish her economic goals. Many of the talking points from both candidates are vague and unspecific and designed to garner votes. It’s the way elections work nowadays.

What I do know however, is that both candidates will probably use the public checkbook way more than what this analyst thinks is prudent, and that will cost us all more money in the long run.

“Watching the markets so you don’t have to”

(end)

(As mentioned please use the below disclaimer exactly) THANKS (Regulations)

This article expresses the opinion of Marc Cuniberti and is not meant as investment advice, or a recommendation to buy or sell any securities, nor represents the opinion of any bank, investment firm or RIA, nor this media outlet, its staff, members or underwriters. Mr. Cuniberti holds a B.A. in Economics with honors, 1979, and California Insurance License #0L34249 His insurance agency is BAP INC. insurance services. Email: news@moneymanagementradio.com

Lifetime Income--> Call me (530) 559-1214