Markets Smell Bernanke Coming! Update July 27th, 2012

Markets Smell Bernanke Coming! Market update July 27, 2012

Marc's Notes:

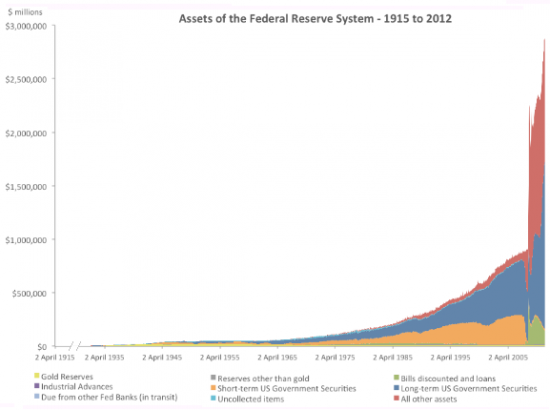

Hey look at that chart! Look normal in any way, shape or form to you? This is a hundred year chart by the way! That spike is all the garbage mortgages your money bought and are now warehoused at the Federal Reserve! They paid FULL PRICE for most of it and bought much of it from Goldman, JP, Citi, B of A, Wells and Fannie and Freddie. Oh yea, hundreds of billions went to foreign banks and firms as well! And now Ben plans to buy even more! Yeah Ben, Go buddy! But wait! Isn't the economy still muddling along? Do we not need more help? Lets look at the stock market where the very rich have their money shall we?

Wow, look at the rally! Bad news is good news now and with bad economic stats recently in the news and the Euro problems getting worse, the markets go UP! Now we are sure Ben Bernanke of the Federal Reserve will save us from ourselves.

The “fixers’ are going to fix things again, the very things they broke, but who is keeping track anyway?

If only the fixers would leave things alone it would fix itself with banks going under, bad investments giving it good to their investors, CEO’s would do jail time, and Mr. Market would teach who has it coming to take their medicine.

If the fixers would have just not fixed us good, we would be a growing economy with cheap houses, smarter banks and businesses, better cars and lower prices for all. Sure, it was going to be a bit nasty but it would have been over and we would be well on our way to a brighter future with low debt levels with leaner and meaner banks and businesses.

Instead the fixers fixed their “friends” only and now the “fix” is in for good for the rest of us.

Saddled now with unbelievable debt and a bi-polar market coupled with inflation, we are basically broken almost beyond repair. But wait, those “fixers” promise us they will really fix it this time, just another turn of the screw, another spoonful of medicine, another whiff of the elixir, and everything will just “catch” and the momentum will make fields of jelly beans everywhere. The unemployed will magically find jobs created by the FEDS and the deficits will disappear! We will all have our homes go up again and the US will again be on top of the world.

Just trust us! One more “fix” will do it this time. “We promise!

And so it goes. Get ready for Helicopter Ben to gas up the Hueys and load the pallets of paper dollars to spew forth from every nook to every cranny.

More money, much more money! Give more to banks and make sure those foreign banks get some! Let’s also drop interest rates even lower than the dirt they are in and force your grandmother to take her money out of the bank and GAMBLE WITH IT in our illustrious stock market that we all know is as safe as bank vaults!

So everybody get ready now! Ben is coming, Ben is coming! Load up! Load up! (Jesting here).

So gold is sniffing Ben’s odor and foreign currencies are too. Both inch up in breathless anticipation! Stocks are in the gate, trotted there by those banks and brokerages you all love and they have harnessed them to run at the command “QE!”

Ben will not disappoint me thinks. There too many counting on it now, Any “non fix” would result in a collective “AW SH-T!” and them hills would be run for!

Heaven forbid, the markets would crash! You can’t disappoint now Ben! Imagine the damage your “no fix” would be!

So come the August month, look up to the skies and listen for the sound of whirling presses. Ben will come. Resurrected in a grand QE 3 or version thereof.

Like the grand resurrection of the Jesus, 3 times, 3 days the charm. And if 3 won’t do it, let there be 4 then 5, then 6, until it’s fixed for good. And that’s what I fear. The “for good” part.

Gold, oil, dividend payers, foreign currencies, offshore money and even offshore property, with a garden, some friends and fine wine. Sounds good to me.

Onward my friends. Stay the course and stay close. Buy local and support your community, family and friends. It’s all we may have in the long run.

Notes:

I opened up a Canadian Bank account. If you want a contact up there, email me!

I am also looking to Everbank for a new Market Safe No Risk CD but no news yet. They do have a nice account for checking with guaranteed high rates. Here is the speal on that one with link if interested.Check it out if looking for a bank account with a good rate, called BONUS RATE. (Forgive the sale sounding text).

Here are the details on the Bonus Rate:

• Bonus Rate increased to 1.25% for 6 months

• Money Market Account First Year APY: 1.01% up to $50k

• Checking Account First Year APY: 0.93% on accounts with $25k - $50k

• Eligible Accounts: All NEW Yield Pledge Checking & Money Market Accounts

Even after the bonus rate period has ended, the Yield Pledge promise ensures these accounts will remain in the top 5% of competitive accounts nationwide – always. This consistently offers some of the highest yields in the nation (currently over 7X the national average for money market).

You can also deposit checks from your mobile phone! The EverBank mobile banking app allows you to simply snap a photo of your check and send the image for deposit. Real cool!

Use the following links for the Yield Pledge Money Market and Yield Pledge Checking accounts if interested:

Money Market:

https://www.everbank.com/personal/high-yield-money-market.aspx?referid=13286

Checking:

https://www.everbank.com/personal/interest-checking.aspx?referid=13286

Money Class 2 is now being offered! September 28th, 2012. 11.00 am in Alta Sierra by Grass Valley.

If you have taken Class 1 and now want to attend Class 2, please email me ASAP! This class will be a smaller setting and take place where Class 1 left off.

We will cover in greater detail:

Real Estate, Offshore Money, Swiss Annuities, How to open a Canadian Bank Account. (We may also plan a group trip there to get everyone who is interested up there and at the right bank! We will also make hotel reservations if you like). We will also go over more gold questions, Apple questions, stock brokerage issues, opening a brokerage account, AND take as many questions as you have in the time allowed. This smaller setting allows me to talk more personably with those attending and answer specific questions. I will also be open to any and all questions in this smaller setting.

Email us NOW to sign up.

Cost is $199.00 per person and includes lunch. Don’t wait. I assume this class will fill up as they all usually do.

New date for Class 1 is not set yet so stay tuned. If we have your old check or you have signed up at KVMR, you still are paid up so you can attend.

Class 1 date and time coming soon so stay tuned to this email. (New sign ups cost $199.00 each and includes food and drink).

If you just want to sign up, then mail us your payment to PMB 101, 578 Sutton Way Grass Valley Ca 95945. Include your email address and what class (1 or 2) you prefer and include your EMAIL ADDRESS on the check. Either class is $199.00 per person. First come, first serve.

Golf too! Let’s get together! Email me to talk shop on the course instead of in class.

Now here is an article for your enjoyment and enlightenment. I think you will enjoy this one immensely.

Managing Your Own Investments - You Can Do it

In our Money Matters investor seminars, we teach investors that handling their own money is not only the most prudent way to keep more of it by avoiding all those fees and sales commissions full service brokers charge you, it can also be more rewarding in many ways.

Not paying your hard earned money in fees to someone else obviously leaves more for you and your family. It also makes more money available to take advantage of the magic of compounding.

Doing some simple math, if you retain that 6 % yourself instead of paying it to your broker in management fees, $10,000.00 saved (which can be only a few years worth of fees otherwise paid to him) will grow into $20,000.00 in a mere 12 years. Hold it 12 more years and you’re looking at $40,000.00 you made for yourself instead of giving it to that “advisor” who simply may buy some mutual fund he was told to sell you picked from some corporate memo he got during his sales trip to that fancy hotel all you “clients” paid for.

Not only will the money you save continue to compound, the longer you manage your own funds, the more you will save, and the more it compounds. Add up a few decades worth of those “fees’ and you could be looking at a few hundred thousand going into your pocket instead of paying for those fancy suits and snazzy offices.

Managing your money is actually fairly easy once you grasp the basics and that “mystique” of stock and fund selection becomes a bit clearer with a few simple hours of the right study. Common sense has more to do with it then you might think and I sum this concept up by having investors go through the following exercise.

If losing money is the most important aspect of investing (and it is in my opinion and the opinion of one of Wall Streets most successful investors, Warren Buffet) ask yourself which is more likely to lose money: some fund you’ve never heard of or some household name every one knows.

During our classes, I will pick out some investor portfolio and read off one of their holdings. You can do this yourself among your friends. Ask a few people if they’ve ever heard of one the funds that your advisor sold you. (While you’re at it, call your advisor and ask him how much he charged you in commissions, loads and sales fees to buy that fund).

If you’re like most investors, your friends will answer “no, we’ve never heard of that fund”.

Then ask them if they’ve ever heard of Campbell Soup, Exxon, Johnson and Johnson, DuPont, Verizon, Coca Cola or Pepsi.

If your friends live on the planet Earth, chances are they’ll nod and say “of course!”

This exercise illustrates the simplicity that common sense provides which will start you on your way to successful investing. Although not a recommendation to buy these stocks nor any stock just based on a name (although I own many in my own account), the companies that make the common things everyone buys, uses and recognizes can be a good place to start looking for where to place your money.

As an added bonus, many of these household names also pay healthy dividends to boot. (Regular cash payments to anyone who holds their stock). Do your stocks and funds pay you cash every so often as a thank you gift? Ask your advisor how many of his “selections” pay 4 % or more each and every year. A stock that pays you dividends can make a sideways market very profitable compared to those go-nowhere mutual funds that just grind up and down for years with no real gains.

You probably already know that the stock market is in about the same place it was over 11 years ago. Have your mutual funds languished in a decade long “go-nowhere” limbo? If you’re like most investors I’ve talked to, probably.

Hold for the long term he says? I don’t know how much long I have left in my term.

In conclusion, brokers and advisors don’t make their money on clients that manage their own account so they strive to keep you in the dark as to the magical ways they handle your money. In reality, you can probably do as well or better doing it yourself if you’re willing to spend a few hours learning the ropes. After all, they’re just ropes, not magic wands, as some would lead you to believe.

Have more questions; feel free to email me at marc@moneymanagementradio.com.

This article expresses the opinions of Marc Cuniberti. Mr. Cuniberti hosts “Money Matters” on KVMR FM 89.5 and 105.1 F on Thursdays at noon. He has been featured on NBC and ABC television and on a host of made for TV documentaries for his economic insights. His website is www.moneymanagementradio.com

________________________________________