New financial update today ! READ January 26th, 2014 "Money Matters"

"An ugly reality"

Marc’s Notes:

Socialism Fails again:

History is rife with examples of attempts by meddling or greedy socialistic type governments taking over private enterprise under the guise of improving life for the common man. The examples usually end badly and it’s usually the government and its cronies that enjoy the improvements while the commoner endures terrible hardship.

The latest in economic train wrecks brought about by socialistic idealists is Venezuela.

Trying to rescue a dire situation brought about by now deceased President Hugo Chavez, Venezuela’s new President Nicolás Maduro (Chavez’s former foreign minister and vice-president) is following in Chavez’s footsteps making a bad situation worse.

Maduro is continuing and in some cases amplifying the same types of policies Chavez instigated, mainly taking over private business and printing a ton of money while enriching himself at the expense of the people he is supposedly trying to help.

With the largest proven oil reserves in the world, Venezuela has plenty of money that the government and President Maduro can steal and use to limp along while they bleed the country dry.

Their massive money printing is causing inflation north of 50% annually and the country is finding it harder and harder to borrow money on the public markets.

With their currency plummeting in value, black markets are rampant. These back room markets always spring up when currencies head south from abuse as people struggle to obtain the things they need anyway they can.

The governments answer to the chaos is right out of the communist manifesto; take over more businesses, jail and kill those who try and stop them, raise taxes and force price controls on what private businesses remain.

Empty store shelves attest to these failed polices and if history is a guide, Venezuelans are in for a hellish ride as the economy and the country implodes under the weight of crushing government and their misguided policies.

This will ultimately give rise to a new system which may or may not be an improvement and the transition will most likely be bloody one.

It remains to be seen what the country will be like when it comes out the other side, but at the present time it’s in the middle of its crack up which will likely last for several more years before it reaches its conclusion.

Government now picks winners and losers:

I just read about a local restaurant in my town receiving a loan from the city to expand its restaurant. One of the conditions of the loan was that the restaurant owner would “create jobs”.

After a bout of uncontrollable laughter I had to scratch my head as I pondered what a municipality was doing in the loan business.

I was under the impression my city council was elected to run the city, not loan out my tax money to private businesses.

The amount loaned was close to a quarter of million dollars, not pocket change by any stretch.

Since I also write for the paper that published the article, I contacted my fellow journalist who forwarded me another article detailing the loan.

The article claims the funds come from a city program called “Program Income Business Revolving Loan Account” which in turn receives its money from the state’s Department of Housing and Community Development Block Grant Program.

Excuse me, but I have many problems with all of this.

First off, that’s what banks are for. To loan money, evaluate the request for loan and determine whether the business can pay back the loan. If the business was not qualified for the loan, why would the city loan the money?

Isn’t the Federal Government giving our banking industry almost zero percent interest money to “get the banks lending again”?

Even if the business did qualify, I was under the impression the State of California was essentially broke. What is it doing borrowing more money to relend it out to private, for profit businesses?

I elect council members and state government to run the state, not do banking with tax payer funds.

Another thing: banks are experts at evaluating balance sheets, city officials are not.

Additionally when the city makes one loan and not the next, the city has then taken on the role of picking winners and losers. If one business received a loan, perhaps his competitor did not. Now the business that received the loan may steal customers with the expansion, (indeed the restaurant was packed when it opened) causing the next guy to lose business and perhaps even go under. The city council has now assumed the role of “God” by determining who survives and who does not.

I learned that one of the city council members had herself received one of these loans. This can only mean the program is ongoing and virulent.

I anticipate our city council members and our state officials not only see no problems with programs such as these but whole heartily support them under that familiar cry of“creating jobs”.

They fail to realize borrowed funds (as California has no money of its own so it borrows billions) also creates debt that has to be paid back, making loans a zero sum game to the economy. But debt also carries an additional charge called interest. Even if the money was free, (which it is not), neither the state nor any city should be in the banking business picking winners and losers at will. That is not in the job description of my city, our state or the federal charter.

I have no problem with the restaurant taking the funds; after all, one of the employees I asked said it was cheaper than a bank.

What I do have a problem with is my elected officials taking liberties that are not part of their job description, and then adding insult to injury by using our monies to do it.

Markets:

More up and down. More sideways. Scary plunges and who knows what’s next. Budget cuts and country blow ups. Gold up then down.

No inflation says the Fed. WHAT?! Meat is skyrocketing and all the stuff I buy is getting smaller in size for the same price! Are you noticing that? Some dividend payers we hold are going ballisitic which means those of you who hold them are making hand over fist in profits AND yield. Those taking advantage of the Monex buy back program I recommended just made about $4,000.00 profit in a year on a $18,000.00 investment!

That’s why we follow Money Matters, to make money!

For now I keep adding dividend payers on my Super Dividend Payers List.

Link here:

http://moneymanagementradio.com/cart/super_dividend

Make sure you have enough physical gold and silver according to the Dream Portfolio.

Link here:

https://moneymanagementradio.com/cart/dream_portfolio

Schedule a brief consult with me if you need direction.

(Email me directly for a reduced rate or use this link:

https://moneymanagementradio.com/cart/consulting

And keep tuned to the shows.

Things to watch for in the coming months:

Gold and silver may make a new low in the $900 or $1,000.00 (gold) and $15.00 (Silver) range before blasting off once again.

War may break out in the Middle East driving oil into the stratosphere.

Drought may make certain stocks take off so keep tuned as to which ones to buy.

Social media and 3 D stocks may have their final blow off before crashing.

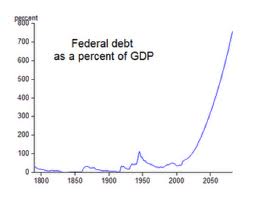

Government deficits will go ballistic and exceed Washington’s predictions only to meet Money Matter predictions reaching 20 trillion in a few short years or less.

More intrusive government and higher taxes.

More wranglings around Obamacare.

Stock markets get volatile as Feds try and taper only to back off as markets start hard down.

Eventual new market highs as money printing continues into overdrive.

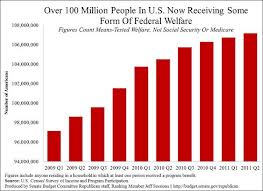

The rich will get even richer (only the 1 %) while the middle class and upper middle class will be bled like pigs. The ranks of the poor will swell ever larger as higher food and energy prices drive more and more people to government assistance.

Small businesses buckle under higher and higher costs.

New jobs will only center around service, medical and part time work. Full time workers will continue to decrease.

Propaganda stating how things are getting better will not translate to your street or town.

More of the same from governments, local and otherwise on creating jobs, the biggest myth since Santa Claus.

Interest rates will stay low for a while longer only to eventually rise crushing housing and bonds.

More economic news that will wow and amaze you, but mostly make you shake your head in disbelief and disgust.

Get ready America, you heard it here first.

Stay tuned!

-------------------------------------------------------------------------------------------------------------------------------------

Money Matters has posted a brand new FREE SHOW! Go the menu on left under FREE SHOW and download it now! It’s the interview I did with the producer of the new award winning movie about our Federal Reserve, “Money for Nothing”.

It’s a blockbuster and everyone should see this movie. The good news is in a few weeks I will be offering this DVD as a gift to you for pledging to KVMR for our upcoming pledge drive! So hear the show then phone in on the drive the first week of February. Better yet pledge by email to me asap and make sure you get your copy and watch it now!~

A new class on “How to get stocks on sale or get paid not to own them” is now open for registration. I am writing a report on this which will sell for about $300.00 per copy but you can get a copy when I finish it AND go to the class for the same price ($300.00) if you register and prepay by February 14th. You must mail in your check to PMB 101, 578 Sutton Way, GV Ca 95945. Make sure it says PMB and not POB.

Make check to E. Cuniberti and give me your phone number and email address. I will pick a date for all to make as soon as I know how many will sign up. So email me now and get your check in the mail today! A limited amount of spots (with the class AND the report) will be available.

Money Matters airs February 6th, 12.00 to 2.00 pm PSA on KVMR FM. 2 hour special.

All for now,

Marc

Our current polices are swelling the ranks of the poor. This chart will continue to rise despite Washington attempt to remedy.