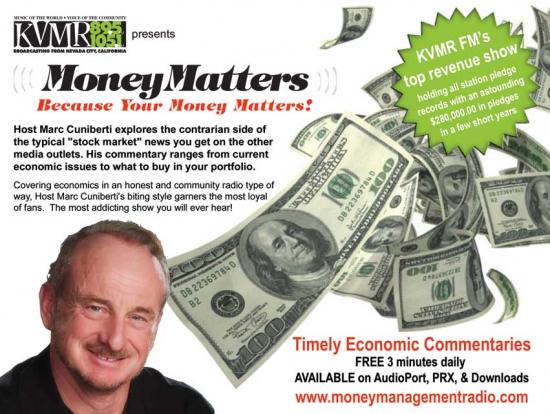

Money Matters airs this Thursday May 6, 2014

Extended 2 hour show on May 6th, tune in!

Marc's Notes:

Howdy! Everyone having fun in the markets? If so, tune in next Thursday!

Also my report on how to get stocks on sale or get paid not to buy them comes out here next week! Stay tuned.

My finger is broken so I cannot type much so forgive me but email me your questions or comments. Now here is some more news:

Real estate or "un" real estate?

Despite the many prognostications that real estate is on a permanent mend, the latest data just out suggests once again that basic economic fundamentals (instead of false hopes or bad weather as was suggested by many) are steering the housing market.

Existing home sales fell 0.2 percent to a seasonally adjusted annual rate of 4.59 million units. Year over year, sales are down an eye-popping 7.5 percent which the biggest decline since the housing bubble burst, save for the periods of 2010 and 2011 when the expiration of government subsidies spurred buying surges and subsequent slow downs.

The annual sales rate is barely above the roughly 3.4 million unit levels during the worst of the financial crisis and not even remotely close to the 7 million annual rate during the peak of the housing bubble in the mid 2000’s and now just out from the Wall Street Journal, their article entitled “Demands for home loans plunge’ detailing that lending declined to the lowest level in 14 years.

With interest rates near historic lows and loan qualification standards almost as lax as they were during the mortgage binge at the height of the boom, what are we to make of these dismal statistics?

Is housing in for some bad news?

Contrarian indicators (seemingly positive signs which pop up at market tops but in actuality can indicate a fall is imminent) suspiciously abound. US housing starts are still brisk at an annual rate of almost 1million units and just last week Nightline (ABC) aired a piece entitled: “Nightline Prime follows couples fighting against high bids in a real estate market that has never been hotter”. Meanwhile median home prices continue to climb jumping 6.9 percent year over year (FHFA figures) with some areas seeing increases in the mid 20 percent range. The latest Gallup survey on investment preferences in the U.S. puts real estate ahead of gold and stocks for the first time in years, reminiscent of the previous bubble when the amount of people favoring real estate as the best long-term investment rose to as high as 50 percent just before the bubble burst.

Does any of this sound familiar?

Similar to the “beginning of the end” last time around however, many analysts and real estate cheerleaders are failing to see the proverbial writing on the wall until it may be too late once again.

The reality is that as interest rates rise, as they have been since the Feds announced their taper of Quantitative Easing (QE), mortgages become less affordable. Median home prices meanwhile continue their ascent further hampering affordability of the mortgage payment. Investor sales have played a large part in the rise in home sales but as home prices rise, the profit in such an investment is eroding. Many are losing interest and moving on to more lucrative areas such as the stock market. Investors, unlike the occupying homeowner, can be fickle and will bail out much quicker than someone who occupies the property.

Making matters worse, large blocks of homes were sold to large investment firms after the crisis in attempt to unload large quantities of homes. These firms have no emotional attachment to what they own and will unload whatever asset starts falling in value. This fact alone could dump massive quantities of homes on the market if they make for the exits en masse.

With the economy failing to kick start with any meaning despite trillions in monetary stimulants and full time job growth still anemic, the case for increasing demand is a hopeful one at best. Adding to the concern, historically, any meaningful economic recovery was led by housing. After half a decade into this so called recovery, home sales are no where near normal, let alone at levels they should be at if a real recovery was underway.

Although no one can know for certain which way the real estate market will go in the near or far term, it will most likely follow the basic economic fundamentals which have always driven this market.

The real players are stable and normal interest rates, strong employment, economic strength and the ability of the market to supply long term and consistent meaningful demand within the parameters of a normally constrained supply, none of which appears to be happening now. The only positive is the Feds money printing programs (QE) which continue to keep the home market from falling flat for now but with the Feds continuing to taper, that support may end soon.

*******************************************

and now from the nations freeways.......

Well our American car companies are at it again, making stuff then calling them back because maybe they didn’t make them so well. We talking about auto recalls and it seems American auto companies excel at this sort of thing, at least that’s my opinion.

I mean how many years ago did Ford have to adapt the “Quality is Job One” motto to try and convince car buyers they fixed what might have ailed them.

Well, decades of recalls later and the auto companies are still doing it; making stuff then calling them back again because they didn’t make them so well. The latest headline grabber of course is GM’s recall because of reported faulty ignition switches that can turn the car off while you assumed and wanted it on.

Unfortunately, as it is with some recalls, some unfortunates may have lost their lives and rumor has it GM knew of this thing way before yesterday.

The graveyard mentality persists where big corporations run the world. Much like airlines, big pharma and big food, it seems not just a few but many people have to die before government believes that these problems can kill people.

Government doesn’t do forward thinking on stuff like this don’t ya know, but needs to see cold hard bodies on the slab before spanking their corporate sponsors and making them fix something that should have been fixed before those bodies became cold and hard.

It seems our auto companies are real good at perhaps making real bad cars and again this is my opinion only but I live my opinion and have never bought an American car save my

Ford f 250 truck with the cross over exhaust when I was a teenager. That truck did manage to get me all the way to Chicago and back before it threw a rod in Montpelier Idaho and I ended up hitchhiking back to California.

Ah American cars you gotta love em. For at least as long as they run anyway.

**************************************************

Looking to finally get ahead in the stock market?

Now a special report available to anyone on how to get stocks on sale or get paid not to buy them at all.

This is a one time special report from Bay Area Process Inc and is only available by special order. (Regular newsletter and website subscribers must access this report by special one time purchase).

This is simple 4 page report on how to get a stock on sale that you want to buy anyway but get it a lower price OR get paid money NOT to buy it!

It’s truly a remarkable strategy and perfectly legal and anyone can do it.

The report is concise and short. You will learn how to pay LESS for a stock you decide you want to buy OR get free money to NOT buy the stock at all!

With this report you also get to attend a FREE class on HOW to do it where you can ask questions, execute trades if you bring you laptop and see how it’s done first hand!

Look for this offer soon.

You get the report AND the class! The class will likely be very exclusive with only a small amount of people in each class so you will get a lot of one on one attention from me. We can go thru the report with a fine tooth comb; you can take notes and execute mock or real trades! You will save money on stocks you want to own and/or make free money by getting paid NOT to buy the stock at all. Either you get in ON SALE or get FREE money! No gimmicks, no tricks; just a simple seldom used strategy. We will also cover if time allows a strategy to make money on stocks you currently own even if they don’t pay dividends!

Don’t miss this once in lifetime opportunity to learn a strategy few traders use but can give you exactly as promised. Get stock ON SALE (for less than current price) OR get paid NOT to buy the stock!

It will be available in just a few days so look for it soon.

All for now, and we talk Thursday!

Marc