Welcome to another Money Matters Update - May 27, 2014

Marc’s Notes:

Welcome new subscribers!

Well a lot has been going on in the markets! Let’s get to it!

The markets are easy to figure out lately. The tug of war between the reality of what REALLY is going on and what they SAY is going on continues.

To put it in plain English, the recovery is driven by Fed money only. Very little organic growth is taking place but the average Joe believes what he hears on TV and Washington stats try and lead us to believe otherwise. Those that look at the real facts and what your are experiencing in your everyday life tell us otherwise.

Our businesses are anemic. Yes we are getting along but where are the customers of old? Our revenues are flat, never returning to the mid 2000 levels. Inflation is eating away at our pocketbooks whether it is from higher prices or smaller packages. Gas again is over 4 bucks and taxes and fees from everywhere eat further into revenue streams. Education expenses are skyrocketing and the healthcare bill is a mess for all except those that are getting subsidies. The rest of us are seeing higher premiums and fewer services. For those of us owning stocks we are doing a bit better but not enough to offset our losses from the melt down. The majority of people don’t own stocks and they are really suffering.

More bailouts are happening that you may not know about. Euro and Ukraine bonds owned by the largest banks are being bought by the central banks of the world to keep them from melting again. Don’t look for any announcements on that. You won’t see it but it is happening. A repeat of many programs to make the banks whole again like the 1987 crash, the Mexican crisis, the Asian crisis, the Long Term Capital Management fiasco, the housing blow up and the Greek/ Euro crisis. Money is printed by the world’s central banks and given to the banking cartels in exchange for any and all bonds that went bad. Theft from the world’s citizens on the grandest of scales in unimaginable amounts and that includes you dear reader. You may not think printing up trillions and giving it to banks affects you but it does and the result is INFLATION. There is no free lunch in printing money. It causes inflation and you pay their bill through the higher prices you pay for everything and it is the reason why your ARE paying those higher prices.

Another bailout coming is the health care bailout. Turns out the insurance companies are submitting their premium applications for 2015 and they want a LOT higher premiums as the people signing up for Obama care are sicker then first thought and up to third of those signing up have not even paid their FIRST premium payment! Making matter worse fewer healthy people are signing up so the costs to the insurers are skyrocketing. Not wanting to show higher premiums, Washington has revised some of the bills measures and now look to kick back billions to the insurers in exchange for their higher costs so they won’t raise their premiums in the coming election cycle. Now not only are you paying to subsidize the premiums of others but you will also pay for the actual services. A double whammy and one predicted by many who oppose the health care act. We were warned the healthcare act was a train wreck and just a year into it and we see few doctors accepting it, even higher costs and now a bailout to the insurers who administer it. This is only the beginning. It will get a LOT WORSE before and IF it gets any better at all. Those getting their healthcare paid for love it of course while the rest of us struggle to keep our plans.

The fact that Washington is hiding this new bailout just makes me sick and should anger you beyond measure. They will protect the reputation of Obamacare through back door deals and bailouts. The cost will be trillions with a T.

The only defense as hard working citizens who pay their own way is to protect yourself from governments looking to grab your money as they squander theirs. Expect more onerous intrusion into your lives, your money, your private businesses and everything we hold dear in this land of the free. (That is becoming more questionable by the day).

We need to:

Earn more income AND more investment income. (Rents, dividends, interest payments and similar income generating placement of funds).

Reduce costs through innovative and efficient operation of our businesses.

Keep your investments under YOUR control and don’t blindly give it to the Wall Street shills who pretend to manage/watch your money.

Get money offshore if you can and away from prying eyes.

Diversify your money in many asset classes. (That is NOT just stocks and bonds).

Seek out alternative investments from people who respect your privacy and know what global diversification is really about.

In this dog eat dog world, you have to excel in your business and investing. Strive to do this in everything you do.

Look for new ways to steal customers from those that fail to realize the world we know live in. There are very few NEW customers. You have to steal customers from your competitors. It’s harsh but it is the new reality.

In conclusion, know this: The central banks of the world know and have only one remedy. PRINT MONEY. They will do this until it breaks economies and it will. If you don’t believe it say to yourself:

“If printing money solves problems, how come we still have problems?”

Nothing more needs to be said. Governments have always done this yet problems persist and have gotten worse. Printing money (stimulus and QE) solve nothing and only make the problems worse LATER. You have to protect yourself with new strategies; new innovation and an open mind to alternative and creative investments that most main stream financiers do not use or even know. Stay tuned and read below for some ideas that fall into this category. Email me with your questions but get moving.

The day of reckoning is getting closer every second, every day, every week, every month. ACT NOW.

Another No Risk product is finally here again from our friends at Everbank. If you recall these NO RISK CD’s come out only once in a blue moon and they are only available for a few weeks so don’t delay. You can’t lose any principal yet have the opportunity to make much more then standard Treasuries and CD’s. It pays 3.3 TIMES the amount of change in the 10 year treasury yield. That is the kind of leverage we need in this low interest rate environment where bank accounts and CD’s yield minimal returns. The best part is it is FDIC insured! The worst you could do is get all your money back.

Early withdrawal should not be considered an option but there is a condition where you can do it but you could pay a penalty so read the terms. As long as you stay in the CD for its term, your money is safe. Each time I put one of these out I inevitably hear from people who just miss the boat until its too late. Don’t be one of them. You only have a few weeks to fund this CD and then it is gone.

Here is how it works:

NEW 5-YEAR MARKETSAFE® TREASURY CD

CD FEATURES

• 5-year term

• $1,500 minimum to open

• 100% protection of deposited principal

• FDIC insured

• IRA eligible

PRICING

Gains on your CD will be driven by the five year performance of the 10-year Treasury yield. Performance will be measured using two pricing dates—June 18, 2014 and June 18, 2019.

SAFETY

In the event the 10-year Treasury yield declines over the next five years, you’ll get back all of your deposited principal upon CD maturity.

LIMITED TIME OPPORTUNITY

The MarketSafe CD is a limited time opportunity with predetermined funding deadlines and CD issue dates. With this latest version of the CD, EverBank has established June 11, 2014 as the deadline to open and fund your account.

PERFORMANCE

If the 10-year Treasury yield goes up over the next five years, all of the upside growth will be multiplied by a 3.3 leverage factor to determine the net return on the CD. This leverage factor provides a unique opportunity for enhanced earnings.

Example:

If you expect the 10-year Treasury yield to grow over the next five years, this is for you, as any upside growth during the CD term will be multiplied by 3.3. Even if the yield goes down, you’ll still recoup all deposited principal.1 See the CD in action via the following payout examples, assuming $10K in deposited principal.

|

Hypothetical Examples |

Ex. 1 |

Ex. 2 |

|---|---|---|

|

Initial Treasury Yield |

2.60% |

2.60% |

|

Treasury Yield at Maturity |

6.00% |

2.00% |

|

Difference |

3.40% |

-0.60% |

|

Leverage Factor |

3.3 |

3.3 |

|

Net Return |

11.22% |

0.00% |

|

Payout at Maturity |

$11.1K |

$10K |

To insure you get the right product, you can use this link:

http://adfarm.mediaplex.com/ad/ck/13305-85986-43235-6?referid=13286

Notes:

1. The Initial and Final Values for the 10-year Treasury yield shall be quoted from Reuters, FRBCMT. In the event Reuters fails to publish the yield for this

bond, EverBank reserves the right to use an alternative index or price determination in its discretion.

2. Principal protection only applies to CDs held to maturity. In the event of Bank failure, the CD balance is FDIC insured up to $250,000. Your other

deposits with EverBank will be aggregated with the MarketSafe CD with respect to the $250,000 maximum. Except in the event of death or adjudication of incompetence of the holder of the MarketSafe CD, you may not withdraw any part of the CD prior to maturity. If you do withdraw early, even if that is due to the death or adjudicated incompetency of the holder of the CD, you will NOT receive Principal Protection and will NOT benefit from any upside potential of the Reference Index, possibly experiencing a loss of principal as an early withdrawal charge. Please see Account Terms, Disclosures and Agreements Booklet.

3. EverBank is not the custodian for all IRAs. You may need to establish a custodial account with a predetermined and unaffiliated third party to maintain your IRA at EverBank. This third party may charge a fee for its service.

Read the entire prospectus when opening the account of anything you plan to buy!

---------------------------------------------------------------------------------------------------------------------------------

Stock and Mutual fund strategy

Now a special report available to anyone on how to get stocks on sale or get paid not to buy them at all.

This is a one time special report from Bay Area Process Inc and is only available by special order. (Regular newsletter and website subscribers must access this report by special one time purchase).

This is simple 4 page report on how to get a stock on sale that you want to buy anyway but get it a lower price OR get paid money NOT to buy it!

Its truly a remarkable strategy and perfectly legal and anyone can do it.

The report is concise and short. You will learn how to pay LESS for a stock you decide you want to buy OR get free money to NOT buy the stock at all!

With this report you also get to attend a FREE class on HOW to do it where you can ask questions, execute trades if you bring you laptop and see how its done first hand!

All this for a one time fee of $399.00. You get the report AND the class! The class will likely be very exclusive with only a small amount of people in each class so you will get a lot of one on one attention from me. We can go thru the report with a fine tooth comb; you can take notes and execute mock or real trades! You will save money on stocks you want to own and/or make free money by getting paid NOT to buy the stock at all. Either you get in ON SALE or get FREE money! No gimmicks, no tricks; just a simple seldom used strategy. We will also cover if time allows a strategy to make money on stocks you currently own even if they don’t pay dividends!

Don’t miss this once in lifetime opportunity to learn a strategy few traders use but can give you exactly as promised. Get stock ON SALE (for less than current price) OR get paid NOT to buy the stock!

Just order it here and you will be able to download the report and then I will contact you to schedule a convenient time to hold our class. Don’t miss out!

Telephone consults are availbable if you live out of the area. Email me for details.

Order now by clicking on the link below and get started making money!

http://moneymanagementradio.com/special-report

Also a new DREAM PORTFOLIO AND SUPER DIVIDEND PAYERS LIST is now posted and available for all website subscribers to download for free OR a one time buy (only $49.00). Consider signing up for a full subscription. You will get ALL the updates for free in lieu of buying it once only. Sign up for 2 years and get the 3rd year free!

These 2 reports are brand new and updated as of this week!

Get cracking and make some money! Especially check out the new SUPER DIVIDEND PAYERS LIST to see investments that pay you to hold them. Dump those go nowhere funds and stocks that just sit there. Get paid while you wait!

Link to website is

http://moneymanagementradio.com/

then go to the side left menu and click on either

SUPER DIVIDEND PAYERS LIST or

DREAM PORTFOLIO!

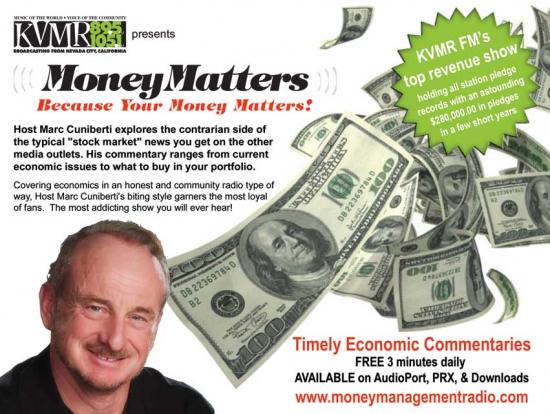

Are you new to Money Matters? Download your free show now!

Go to the left menu under “FREE SHOW” and see why we are the fastest growing alternative money show on the radio!

That’s all for now,

Marc

Me at the lion's lair!