Is it over?

Keep reading

CAPITULATION

The continuing erosion of a stock markets is a painful event for investors. Like the latest 7 week period starting around the first of the year, the market seemingly fell almost nonstop until last Thursday, February 24th.

Only interrupted by brief one day rallies, the Dow fell almost 10%, and that was the good news. The NASDAQ continued what it had started in Mid-November and crashed 18%. The other indexes fell in concert and by similar amounts.

Although no one can forecast market direction with 100 % certainty, prolonged, slow-motion types of crashes usually don’t just peter out and grind to a halt.

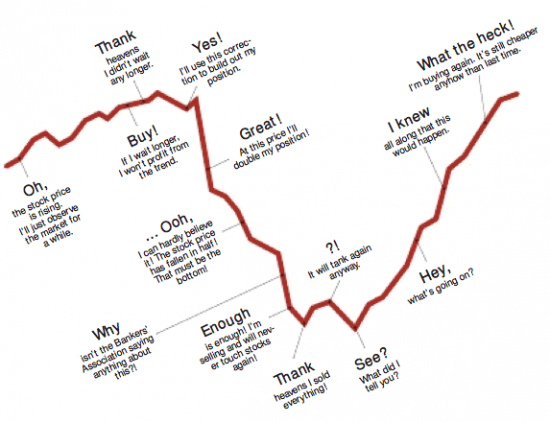

Simply put, when a market starts a descending type of pattern and continually erodes week after week, it can take what is known as a “capitulation” event to signal an all clear might be in the cards.

Capitulation is defined by Wikipedia as: “to surrender or give up. In financial circles, this term is used to indicate the point in time when investors have decided to give up on trying to recapture lost gains as a result of falling stock prices”.

Specifically, as markets begin to fall, many investors will step up and buy more of shares of stock they might already own, thinking they will average down their costs, buying more shares at lower prices.

For example, an investor buys 100 shares of ABC Company at a price of 4 10. His cost for the 100 shares is $1,000.00. Then, for whatever reason, the share price drops to $5. The investor buys 100 more shares at $5. Now he has 200 shares at an average cost of $7.50. as he bought 100 shares at $10, and 100 shares at $5.

This “averaging down” is a common occurrence among many investors (this analyst is against such practices, based on the belief a stock might be falling for a reason and one should not buy a stock just because it is cheaper in price).

In a prolonged market crash, the slow motion erosion continues to pressure stock prices, yet some investors start this averaging down process and buy more shares. This may prolong what may have been a brief market set back to a prolonged stair step down type of market, whereas the markets general direction is down, yet the downward bias is interrupted by bouts of stock buying, which causes brief rallies.

If the market continues down for whatever reason (in the case of our most recent 2022 crash, it was inflation concerns exasperated by the Russian/Ukraine event), those that averaged in and bought stocks see their losses accelerate, as they now own even more shares.

In cases like these where a prolong market erosion seemingly never ends, what is common is to see finally occur is a capitulation event.

This event takes the form of an all-out panic type of crash. They are usually brief, but horrific one or two day sell offs, which take the indexes down hard. Usually a multiple or many multiples of the previous one day sells offs witnessed as the crash progressed.

In the most recent event, after 7 weeks of brutal stock erosion, the evening Wednesday, February 23rd, showed stock futures (a pre-indicator that estimates the following day’s stock moves) down a whopping 800 plus Dow points. After 7 weeks of erosion, the 800 point “hard down” indication was frightening to those that saw it.

Indeed, when the market opened up Thursday the 24th, it started hard down, in what seemed like capitulation. Buyers had all but evaporated, and it appeared an all-out panic had gripped market participants.

Within hours however, apparently finally realizing prices had fallen too far and for too long, buyers stepped in and stocks came off their lows.

What seemed like the start of a bleak day, may have actually signaled the capitulation event that the market needed to see before it could finally halt its prolonged descent.

Although only time will tell if we are indeed out of the woods as far as a continuing market crash occurring, last week’s event certainly fit the description of a classic capitulation occurrence.

No one can predict market movements at any time. This is not a recommendation to buy or sell any securities. This article expresses the opinion of Marc Cuniberti and may not reflect the opinions of this news media, its staff, members or underwriters, nor any bank, brokerage firm or RIA and is not meant as investment advice. Mr. Cuniberti holds a degree in Economics with honors, 1979, from SDSU. His phone number is (530)559-1214.

Questions?

Call Me

(530) 559-1214

Annuities

Money Management

Retirement solutions

Medicare

Life and Accident Insurance

Fire Insurance