What will the New Year of 2020 bring us!

Greetings fans and wishing you the best of new years!

As we embark on a new year, many will make promises and resolutions full of hope of new beginnings. A worthwhile endeavor for sure. All of us have things we would like to change, some easy to change and some we may have been trying to change for years.

Financial resolutions are a popular resolution as are health changes, weight loss, relationship and job changes, life goals and many others.

Change in the positive is just that, positive. The resolution we hope will improve our lives and maybe even lives of others, and herein lies my message for you today.

Let’s see if we can make up and make a resolution, a specific resolution to help someone else. Whether it be care for an elderly, volunteer at a shelter or food bank, clean up a park or just reach out to someone. It might include a monetary donation or just giving part of your time. Whatever is it, it is said one of the most selfish things one can do is help someone else. A strange take on the charitable action for sure. But in it lies the truth of it. Helping someone else makes one feel great. It’s uplifting and one of the best anti-depressants one can take, and all without drugs with the added benefit of someone else benefits too.

Simply put, let’s all make a resolution to help someone else. Each one Teach one. And you might find this resolution the most uplifting and rewarding of resolutions. And while we’re at it, let’s take a moment and look not forward on the year, but backwards. And no in retrospect but in gratitude. Gratitude for what we have. The most obvious one is just being here for another year. Some of our loved ones or friends may not have lived to today, 2019 being their last year on earth. But we can be glad we knew them at all. And that they knew us. For to love is to eventually know love lost. But it is the way of things, as it should be and is.

In this New Year, we look back with gratitude, gratitude for all we have and all we have known. And with our resolution to also help others, I for one cannot think of anything I would hope for more as this New Year brings its dawn upon us.

Wishing you the best of New Years and the best of past years.

-----------------------------------------------------------

Income or growth?

Will who gets elected matter?

276107

Discussions about what will happen to the markets because of the fall presidential elections run the gamut from all out Armageddon to no effect. In my opinion what happens to the markets will likely happen before the November voting date. Polls will certainly forecast who is in the lead and likely to win but if the Trump election is any indication, a close race will bring up memory of the Trump surprise and it may indeed come down to the wire. A Trump win will likely be positive for markets if history is any indication seeing at his last victory started the market out on an historic 3 year run with an approximate 37% increase. A radical left candidate like Warren getting close might cause market indigestion if we are to believe a plethora of market gurus forecasting such a thing.

The impeachment proceedings are likely a temporary distraction as even if impeached he will likely remain in office much like Clinton did. As impeachment proceedings march along, the markets don’t seem to care much. Not that markets won’t react if it actually takes place but in my opinion it won’t have as much effect as some are forecasting. Keep in mind no one can forecast market direction anytime, anywhere and no how but we can draw on historical patterns.

The election year cycle is a study of market direction based on what year in an election cycle the market is currently in. Since 2020 is an election year, it’s the fourth year of the election cycle. Going back over 50 years, the market generally fare well in the fourth year. A 7.5% average increase marks the fourth year cycle. The third year holds the record out of the four year cycle for those wondering. In fact there was only one instance where the fourth year yielded a negative performance which occurred in 1948.

Should a republican or a democrat get elected, no one can say what will happen as in all market prognostications, but history has its say. A democrat swearing in on average yields a 5% average loss while a republican newbie yields a 9% return.

Fast reverse to today and the markets seems to not be too concerned with the move to impeach. Rumor has it impeachment is a fast track to a victory for somebody, but who that somebody is remains unclear. A backfire is possible as well as the obvious outcome so there we go again. No one can say for sure what markets will do even if an impeachment takes place. It’s that unpredictable.

The plot thins and it goes back to who knows. The economic impact of an impeachment and the election could go any which way. Which leads us back to investing versus betting on election. Your best bet would be to not to and continue to follow Modern Portfolio Theory (MPT) which means adequate diversification in your holdings and maintaining some sort of exit strategy if things go south in a big way for whatever the reason.

------------------------------------------

Does the Federal Reserve has problems with the money system?

Are the telling us everything? Keep Reading

275431

Covered before in Money Matters, the overnight repurchase agreement mechanism (REPO) is an arrangement between the Federal Reserve and member banking institutions.

From my previous article:

“The REPO market is the plumbing of the financial system. The banks and market participants of all types rely on this REPO market to finance their day to day operations. Billions of dollars flow into and out of this market daily. It’s where business and investment firms of all types draw on funds to operate, while others deposit excess funds for safekeeping and possible income. The market operates funding for as short as overnight to longer terms”.

How it operates is explained by CNBC:

“In a repo trade, Wall Street firms and banks offer U.S. Treasuries and other high-quality securities as collateral to raise cash, often overnight, to finance their trading and lending activities. The next day, borrowers repay their loans plus what is typically a nominal rate of interest and get their bonds back”.

The REPO market seldom needs cash infusions from the Fed as the inflows and outflows of the mechanism usually furnish enough funds for the markets and businesses they serve to operate. In fact up until about 9 weeks back, the last time the Fed injected money into this mechanism was 2008/09.

Those dates ring a bell?

They should.

The global financial institutions literally imploded from the real estate bust. But that was then and this is now. Since then the REPO market has been operating just fine on its own. That was up until about early September when the mechanism suddenly found itself short of liquid cash. Two weeks later and after a whopping 70 billion was injected, I penned the article (Link to article: https://moneymanagementradio.com/node/1073)

Turns out the injections by the Fed are intensifying according to the financial newspaper “The 5 MIN FORECAST”. David Gonigam, managing editor of the “5” as it’s called, says close to a third of trillion has now been injected by the Federal Reserve. Rumor has it that mega-bank JP Morgan spent 77 billion “propping their shares up” AKA stock buybacks, and that stock buyback money would have gone into the huge bucket that the REPO market is. Alas it didn’t go there hence that was the problem.

Or was it?

The REPO market has been around a long time and it’s seen a whole bunch of financial “stuff” happen in the world, stock buybacks being one of the least of them. And no such Fed injections have been needed.

The JP Morgan stock buyback used up 77 billion true, but 77 billion is not generally thought to be a large enough amount to cause a jam in the REPO system.

Since it has required ongoing cash injections in recent months and such injections have not been necessary since 2008, it may mean all is not well in the money plumbing of the financial system, this mysterious and complicated REPO mechanism.

Whatever the case may be, this analyst is losing some sleep over the whole thing and carefully watching the financial markets with a bit more scrutiny lately.

If more funds are shuttled from the Fed into the REPO market, bigger things than a stock buyback may be afoot. This market rarely springs a leak for little or no reason, but like a slow leak on a cruise ship below decks, it’s not something those in the pilot house want to advertise. Instead only when it’s time to abandon ship will the calls over the public intercom be heard.

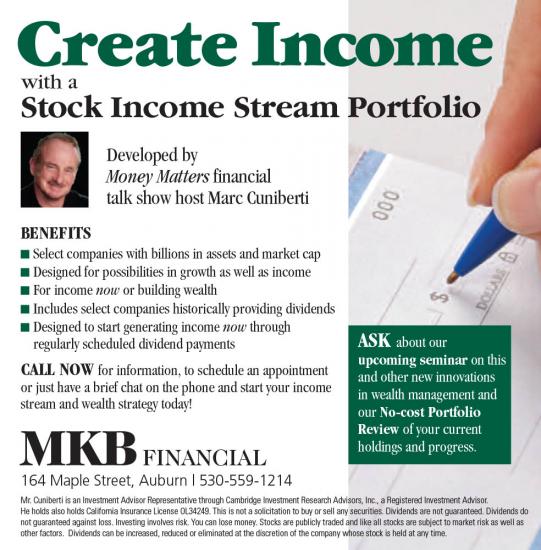

These articles express the opinions of Marc Cuniberti and are opinions only and should not be construed or acted upon as individual investment advice. Mr. Cuniberti is an Investment Advisor Representative through Cambridge Investment Research Advisors, Inc., a Registered Investment Advisor. Marc can be contacted at SMC Wealth Management, 164 Maple St #1, Auburn, CA 95603 (530) 559-1214. SMC and Cambridge are not affiliated. His website is www.moneymanagementradio.com. California Insurance License # OL34249