Is a market correction overdue and in our near future?

They say history never repeats but it sure can rhyme.

If that’s the case, I feel like writing some poetry today.

During the first week of February 2020, I was sent photos of an empty city in China by an acquaintance of mine, that city being the now famous metropolis of Wuhan.

As I stared at the empty airport and shopping malls of what would later become, arguably, the birthplace of CoVid-19, my mind immediately connected to the concern I had about the markets and where they were headed due to the Trump tariffs.

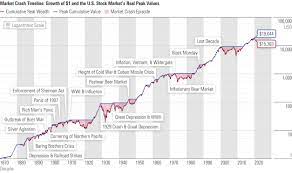

With the Dow close to an all-time high, rising from the Trump election in November of 2016, I was already looking for an excuse to move portfolios out of the markets. The fear, at that time, was that the tariffs imposed on China would knock China GDP (total output of the economy) down by more than a percent, and that the markets would sell off on a weaker than expected Chinese GDP number.

Seeing an empty city in the busiest country on the planet due to some virus called Corona, I went back to research the effect a similar event had on Chinese GDP.

The 2003 Severe Acute Respiratory Syndrome (SARS) event sickened about 8,000 people and had a mortality rate of 10%. SARS caused Chinese GDP to back off 1%, and back then, China was only the 5th largest economy worldwide,

Doing a quick check at worldometers.info/coronavirus/ (an excellent site for CoVid stats), mortality rates were at 3% and the number of CoVid infections stood at 35,000. A shockwave went through me. With the Dow at or near an all-time high, with the tariffs already causing me concern as to their effect on the Wall Street, and now staring at a virus that already had ten times the infections then SARS which knocked off 1% off Chinese GDP, and China now the second largest economy in the world, I penned an article Feb 10th, 2020 entitled “Corona Virus Effect on Markets”.

The article’s main theme was that investors were not considering the possible effect that an exploding Corona virus could have on markets.

Specifically I wrote:

“Unless Corona is soon contained, a lingering presence could rattle markets long term with severe consequences being possible” (Feb 10, 2020)

“Severe consequences” turned out to be true if not the understatement of the century.

On my subsequent Money Matters radio program I warned the same and announced I had initiated appropriate measures in stock portfolios.

Starting a few weeks after that article, in the first few days of March, the Dow began its historic 38% slide in a record shattering time of only three weeks.

Fast forward to today and I am beginning to get the same feeling as I did back then.

The similarities are striking. The Dow is again pressing up against an all-time high. Bailout packages, unemployment bonus checks, paycheck protection reimbursement programs (PPP) and other subsidy programs have ended or are ending soon. CoVid cases are spiking and in certain areas, exceeding the highest infection rates of the summer of 2020.

We are finding out that the vaccines are not the panacea we thought they were, and in the midst of a massive resurgence of the new Delta variant, much of the U.S. is reopening with a vengeance.

Theme parks are open, football stadiums will soon be packed full of fans, 700,000 motorcycles enthusiasts will soon be arriving in Sturgis for the annual motorcycle rally, and restaurants, theaters and other venues are opening up to record crowds.

Once again, I find myself looking for a reason to sell in an attempt to preserve that which the rebound in 2020 may have given us. Once again, I have installed stops (orders to sell should prices drop) in all portfolio positions.

Although such methods do not guarantee against losses, stops can help eject positions automatically if markets start down hard.

And like a bad dream that keeps coming back, Wall Street investors seem to be ignoring the possibility that once again, as CoVid revisits its assault on the human species, in its doing so, could also once again cause a severe reaction in the markets.

Keep in mind no one can predict market movements at any time and past performance does not guarantee future results. Contains the opinions of Marc Cuniberti only and should not be construed as investment advice or a solicitation to buy or sell any securities, nor represents the opinion of any bank, investment or advisory firm. Neither Money Management Radio (“Money Matters”) nor Bay Area Process receive, control, access or monitor client funds, accounts, or portfolios. California Insurance License #0L34249. Insurance services offered independently through Marc Cuniberti and not affiliated with any RIA firm or entity. (530)559-1214