If you woke up this morning its because no damn fool pushed the button yet. Wow, what a world.....

Marc's Notes:

I am doing a video series called “Investing in your Community” where I profile businesses and events happening in our county and indeed the world. You can check out many of these videos on my Facebook page here; https://www.facebook.com/marc.cuniberti

If you have something that might be of interest you would like me to cover in this video series, email me. The videos are short and fun.

My son Kyle has a few spots left to earn himself a college education. He refinishes decks and fences. They look great when done and his quotes are usually way below others that do this type of work. Protect your investment! He also will do odd jobs at a very reasonable rate. Give me an email or call me at (530) 559-1214.

I am also looking to pay cash to rent a house in the Tahoe area over the winter for a week or 2. We are VERY clean and respectful renters. Email me or call me if you know of something or someone that might fit the bill. Donner Lake, Truckee, Tahoe, anywhere up there. If I rent the property I will pay a $100.00 referral fee to you!

I have a few spots for consults at no charge to review your holdings and take a look for you. There is no cost or obligation but there is a minimum of course so call or email me.

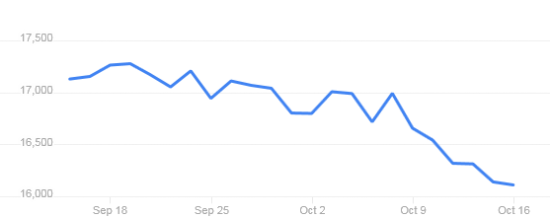

Here are some market tidbits to chew on if you feel like reading up on what is happening in this traditional slow time in the markets. As mentioned (and approved) in recent shows, in the past few weeks I am adopting more of a neutral market stance and am watching carefully these markets! Sometimes markets fall in the fall and although no one can predict market movements at any time, the rally which keeps going is keeping me more alert than in any time during the last 9 months or so

--------------------------------

206178 approved

Are we in for a redo of something like this?

Urgent Update:

Greetings. It’s a good time to review and update you on the investment profile and reasons/causes of our trades in the last year.

As indicated in previous Money Matters shows, until Donald Trump was elected President we maintained a market neutral to market negative stance meaning a market rally of any significance was not expected. Our stance changed from market neutral/ negative to market positive after the Trump election on November 8, 2017.

With the surprise election of Donald Trump, I received a few calls about concern surrounding the markets. I did pen an article in response to the many emails and calls and it is attached below. Although the night of the actual election showed a market which was going to start in turmoil on November 9th, that morning the market moved drastically higher. The Dow rose from the 17,000 to where it is today at over 21,000. Fixed income however sold off significantly which partially offset gains from the other sectors. Fixed income is held for income and is less volatile historically and is held as diversification.

Last month as indicated on Money Matters shows, I became concerned the rally was running out of steam. The rally was long and fierce and many sectors had risen

significantly. Utilizing trailing stops once again to retain profits, I sold out partial positions in a handful of positions including but not limited to utilities, technology, China and infrastructure.

We still hold a global position as well as a few select areas of investment.

I actually added biotech, and energy in recent days and weeks as those sectors may be attractive areas as demonstrated by their price action and investor sentiment.

An interesting side note is commodities and energy seem to be exhibiting interesting patterns that may indicate a change is in the works in the area of inflation, something many analysts have been scratching their head while trying to analyze this phenomenon. Should these sectors continue to behave as they have been, this could be a sign inflation may be finally set to pick up noticeably. This will make for an interesting investing environment should this be occurring.

In conclusion, a mix of fixed income and equities is held to provide directional balance and income while maintaining select positions in the markets. With an eye on principal protection at all times, I remain overly cautious at this point in time. The fall season can bring market upheaval historically and the run in the markets has been historic. I am actively and with concern watching the markets especially now and in the coming weeks. Should a correction appear to be materializing I believe we are well positioned to respond accordingly. With special areas of interest being slightly overweight at this time, there also exists the possibility for positive performance. With principal protection being the most important aspect in our portfolios, we now remain in a neutral stance to the market with select holdings in certain areas.

As in all areas of investing, past performance cannot guarantee future results. Dividends and interest payments will not guarantee against loss and are they themselves not guaranteed. No one can predict the direction of markets or investments. This is not a solicitation to buy or sell any securities. Investing involves risk with the possibility of loss. Our clients can see your website/ brokerage statements for exact balances, fees, performance and income. Please call this office with any questions you may have. You may have me review your current financial condition and holdings by meeting with me at no cost by emailing me or calling my office to set an appointment. (530) 823-2792

Watching the markets so you don’t have to,

Regards

marc

----------------------

Many think the nation would have been better served by Hillary- What do you think?

198808 approved

As a financial advisor, I have to analyze and communicate market information to my clients. They likewise should communicate their needs, expectations and preferences to their advisor as to what certain areas what they want do and do not to invest in if they have a preference, how conservative or aggressive they want to be and what their financial needs are both in the short and long term.

It’s a forgone conclusion to say that many advisors may have received phone calls from their clients regarding their concern over the Trump election and how his policies and actions as President might influence markets. Some clients have expressed more than a minor concern and some have even requested an all cash positon preferring to be out of the market all together.

Although definitely the most controversial president elected in recent memory, his actual effect on markets will likely be tampered by the reality of what he actually can and cannot do.

Our political system has many checks and balances designed to limit the power any once branch or person has and in that may lie the answer to the many concerns clients might have.

Any major policy action will require the support of the legislative branch and in many cases also the judicial branch of government. Although Trump may talk a big game that his many radical ideas will be carried out, in actuality, his hands will be tied on many issues as all Presidents hands have been.

That said, clients concerned about Trump policy will take some comfort in knowing that portfolios do not have to be all “long”. This means one does not have to structure possible gains around an exclusively rising market.

Proper allocation and a diversification of assets may have a tendency to counter balance each other no matter which way the market might go. Although no one can say with certainty that the performance of any investment will go one way or the other, advisors can allocate certain contrarian positions based on their historical performance. Keep in mind past performance of any asset does not guarantee success and a knowledgeable advisor will know that.

A mix of fixed income, traditional stocks and funds, cash and cash equivalents can be tailored to reflect a more conservative posture for clients concerned with the new administration. Advisors can also look to areas the new president has pledged support by reviewing his campaign promises and Trumps suggested areas and programs where funds might be spent by.

Although investors are correct in voicing their concerns, history has a pretty good track record in demonstrating it can be difficult in today’s political structure for any one person to drastically alter the landscape of the global financial markets considerably and for an extended period of time.

That being said, history never repeats itself so the old adage “never say never” comes to mind. If you’re concerned about the direction your investments might take in light of the current administration, a meeting with your advisor will be beneficial to insure your concerns are heard and your portfolio holdings reflect that concern. An experienced advisor should possess the knowledge to structure a portfolio to reflect the client’s needs and expectations at any point in the investment cycle. Your opinions matter and you should not be shy in voicing them, especially when it comes to your financial future.

After all, it’s your money.

Please remember discussions in this news piece should not be construed as specific recommendations or investment advice. Always consult with your investment professional before making important investment decisions. This article expresses the opinions of Marc Cuniberti. Mr. Cuniberti is an Investment Advisor Representative through Cambridge Investment Research Advisors, Inc., a Registered Investment Advisor. Marc can be contacted at MKB Financial Services 164 Maple St #1, Auburn, CA 95603 (530) 823-2792. MKB Financial Services and Cambridge are not affiliated. His website is www.moneymanagementradio.com. California Insurance License # OL34249

Money Matters airs Thursday August 17, 2017 at noon PST on KVMR FM and worldwide at moneymanagementradio.com.